Noah Smith has some good observations about a recent Martin Feldstein piece in which Feldstein claims that interest on excess reserves is keeping inflation low because it’s enticing banks not to lend out their reserves or make investments. Regulars know where this is headed. Sigh.

Noah’s explanation is pretty good. But I think he makes it too complex. You see, banks never lend reserves. The amount of reserve deposits in the Fed system are determined exogenously by the Fed. When a bank wants to make a new loan to a creditworthy customer it ensures it has the capital and simply makes the loan. If it needs reserves then it can find them after the fact.

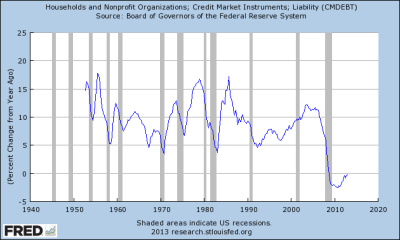

Now, Post-Keynesians know that loans create deposits. That is, a bank can create new money simply by creating new loans that lead to new deposits. It doesn’t necessarily need reserves to “multiply”. It simply needs capital and creditworthy customers walking in its doors. The problem with today’s environment is not that the banks are holding a huge amount of reserves and unwilling to lend or being paid to hold them. The problem is that there aren’t enough creditworthy customers walking in the doors to demand loans. If there were we wouldn’t see data sets like this one at levels that are reminiscent of some sort of catastrophe:

(Household Debt)

It’s worth noting that this has all been discussed broadly in Fed research papers already (literally for YEARS). Many people at the Fed know what they’re doing and for some reason most mainstream economists simply refuse to try to understand how banking or central banking works. Here’s the key quotes from the horse’s mouth in a paper that has been circulating for two years (via the NY Fed):

“In this note, we present a basic model of the current U.S. banking system, in which interest is paid on bank reserves and there are no binding reserve requirements. We find that, absent any frictions, lending is unaffected by the amount of reserves in the banking system. The key determinant of bank lending is the dfference between the return on loans and the opportunity cost of making a loan. We show that this difference does not depend on the quantity of reserves.”

That’s basically all there is to it. No need to make it more complex than that in my opinion. If there’s a “macro war” going on the Post-Keynesians just took down one of the mainstream’s generals who proved he doesn’t understand how modern banking works.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Tom Brown

So your “Most Popular Posts” box still indicates the number of comments that were present prior to disqus, but now with disqus all the comments are not visible?

I hope my old links to some of my favorite comments are still active somewhere… I haven’t checked yet, but that would be great if they were.

Cullen Roche

The old comments should be importing at some point.