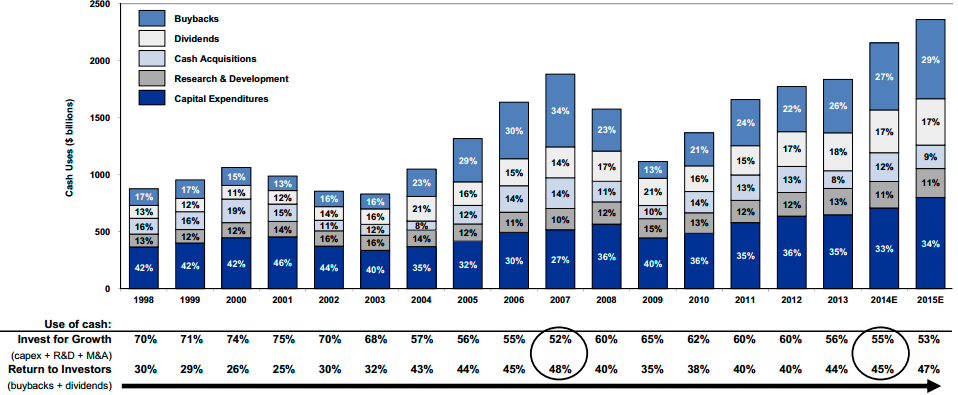

No, dummy. We’re not going to talk about “investment” in the sense that everyone abuses the term – as in stock market “investing”. We’re going to talk about real investment – spending, not consumed, for future production. Anyone who’s read my primer on the monetary system knows that investment is one of the most important drivers of overall economic growth. And while investment has been relatively robust over the last 5 years it is interesting to think about how much more robust this could be. For instance, take these two charts. The first is from Goldman Sachs showing how corporations are spending:

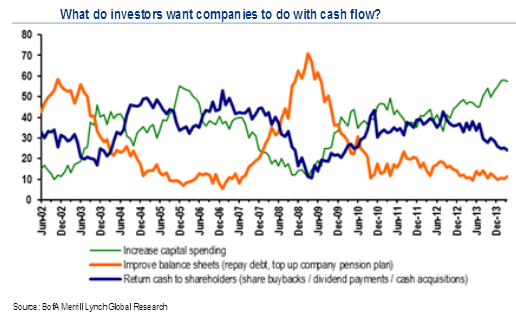

Now look at what investors want companies to be doing with their spending:

Corporate balance sheets were never a big problem during the crisis (with the exception of banks and many non-bank financial firms). But what’s interesting is that investors really want more capex and yet corporations seem to be involved in their usual pro-cyclical increases in dividends and buybacks. It all makes one wonder – why aren’t corporations actually pouring more money into their own firms as opposed to just handing it back to shareholders? My best guess is that it’s a lack of demand combined with the short-termism that has come to dominate corporate board rooms. After all, buybacks are a great way to “make numbers” and boost short-term incentives without hurting the corporate income statement.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.