The following is an excerpt from a recent Orcam Investment Research piece:

Thoughts on the “Great Rotation”

It’s been difficult to escape discussion about the “great rotation” in recent weeks. In case you’ve been hiding underneath a rock, the idea of the “great rotation” is that investors are presently in the process of “rotating” out of bonds and into stocks. There are three big misunderstandings being made behind this thesis:

- First, investors don’t “rotate” out of stocks and into bonds.

- Second, the end of the bond bull implies an end to easy Fed policy.

- Third, the bond bull has been weaker than most presume.

The first point is a very fundamental fact about secondary markets. We must understand that all securities issued are always held by someone. There is no such thing as “getting out of” stocks or bonds. You can sell to someone else who exchanges you their cash position, but in the aggregate there is no such thing as “getting out of” stocks and moving into bonds. All securities issued are always held by someone. It’s better to think of money as moving through securities and not into them.

Ultimately, what determines the price of these securities is the desire of the buyers and sellers to acquire or dispose of those securities. But the idea of a “great rotation” is a great misnomer. It implies something similar to switching from Makers Mark to Jim Beam as your preferred form of whiskey.* But stocks and bonds are not consumer products that we can switch in and out of. They are savings vehicles issued as liabilities of the entities who issue them and they are always held until retired.

The second point revolves around the idea that government bonds are no longer an attractive asset class. This might make sense were it not for such an accommodative Fed policy. Ultimately, Treasury Bond prices are pegged to economic conditions and the Fed’s perception of economic conditions. Bond traders will adjust their holdings of Treasury bonds based on their perception of future Fed policy. But future Fed policy is contingent upon future economic conditions.

Thus far, the Fed has been very clear about future policy due to the continuing weak economic environment. They will not ease off the accommodative pedal until they see 6% unemployment. That means we’re staring at a 0% Fed Funds Rate for the foreseeable future. Since long rates are an extension of short rates I wouldn’t expect huge deviations in t-bond prices unless we see a roaring economy in the coming years (IF we see a roaring economy at all). And while I’ve long been optimistic about the economy I would not peg high odds on the sort of growth that would lead to 6% unemployment in the coming 12-18 months.

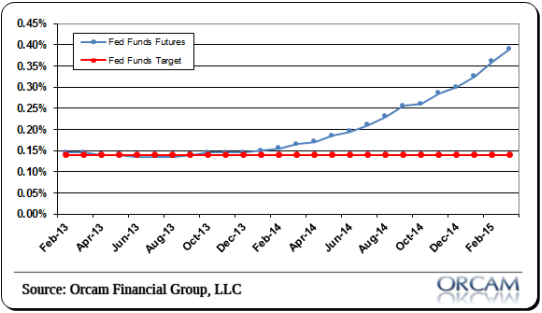

It’s also helpful to put this into perspective by looking at the current guesses of those bond traders trying to front run the Fed. At present the Fed Funds Futures curve is much steeper than it was just a few weeks ago (see figure 1). Traders are now pricing in a rate hike as soon as early 2015. I think this is probably optimistic.

(Figure 1 – via Orcam Investment Research)

The risks to the US economy will remain many in the coming years as the Balance Sheet Recession lingers and government spending slows. It’s also highly unlikely that the unemployment rate will drop below 6% before 2015. That likely means the bond market is overly optimistic about future rate hikes and we’re likely to see that curve shift to a flatter position.

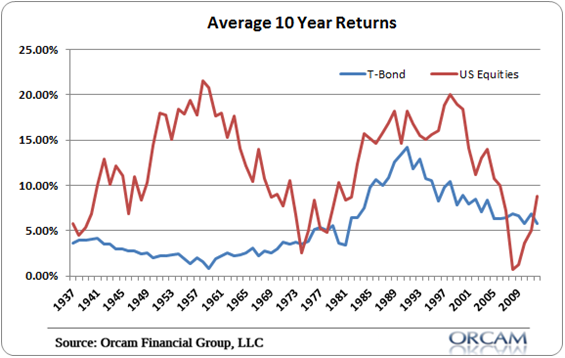

Lastly, I think it’s important to keep the bond bull market in perspective. Since 1928 the average annual return on Treasury Bonds was 5.4%. Meanwhile, the trailing 10 year returns on Treasury Bonds has been 5.76%. In other words, the recent returns have been far lower than most presume and much more in-line with the average annual return. While it wouldn’t be surprising to see this rate of return revert further to the mean I think it’s a stretch to imply that the bond market is as deeply into “bubble” territory as we constantly hear about.

(Figure 2 – via Orcam Investment Research)

In sum, I think it’s important not to get too caught up in these dramatic sort of concepts that imply we are presently in the middle of some sort of paradigm shift. Bonds aren’t going away. They’re not going to become a less important part of people’s portfolios. Investors aren’t “getting out” of bonds. And while the next 10 years are not likely to be as favorable to bonds as the last 10 years I wouldn’t fall victim to the idea that you need to dramatically shift your portfolio to account for what sounds more like a marketing ploy than sound advice.

* While we are not in the business of providing specific investment advice to clients, we would highly recommend against ever making this “rotation”.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.