One thing I keep reading all over the place is this myth that a recession won’t happen because residential real estate is appreciating. Of course, the implication is that rising prices mean increased residential real estate activity, etc. But the reality here is that recessions just about ALWAYS occur with home prices still appreciating.

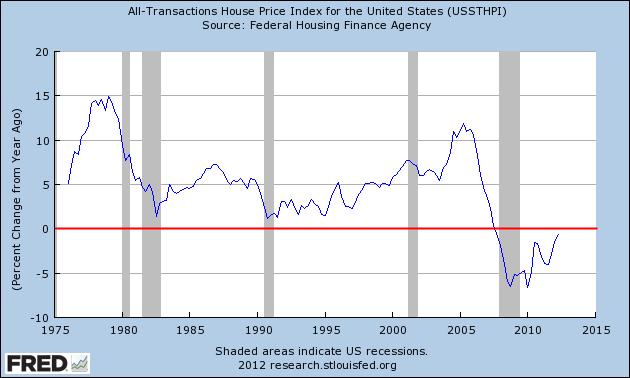

As you can see in the chart below, in the last 40 years recessions have always occurred with rising home prices (with the exception of the 2008 recession).

Now, I’m not in the “recession is coming” camp and I’ve been pretty vocal in expressing this sentiment (especially in the last year), but the US economy is much bigger than its real estate market and tends to experience volatility over the course of the business cycle that doesn’t involve contraction in US housing prices. US real estate is generally a very steady component of the US economy which is what made the recent recession such an anomaly. But I think there’s a nasty case of recency bias leading people to make unfounded statements about how real estate expansion/contraction plays a more important role in economic contraction or expansion. Clearly, the history of the last 40 years shows that the US economy can contract without real estate prices contracting.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.