I was running around San Diego this afternoon and noticed an unusual amount of housing activity. Contractors are literally coming into the beach communities, making above market offers on beach cottages and then tearing them down so they can build two ________ (insert description of your choosing) looking million dollar condo units on the lot. It’s a flippers dream come true with all the 1950’s beach cottages here. But that got me thinking about all of the stories I’ve been hearing elsewhere on the west coast in places like , LA, Seattle and San Francisco where friends of mine say the housing market is starting to get crazy again. That said, let’s review some of the data here.

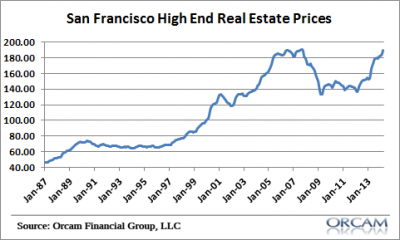

The most shocking real estate prices are high end San Francisco where there’s little doubt that the bubble era prices are back (and remember, this data is almost a quarter old so prices are actually higher than what we see here):

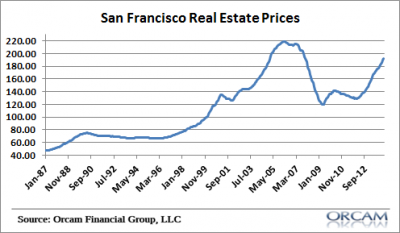

The entire region looks a bit more subdued, but not by much:

The Los Angeles market is showing similar signs with prices still 20% below the peak, but showing the same sort of trajectory as the San Francisco market and eerily similar to what we saw in the run-up to the bubble:

Similar story in Seattle where prices are now only about 10% below the bubble peak:

Now, I certainly hesitate to use the word “bubble” to describe these prices. Trends in San Francisco certainly look alarming and unsustainable. And it looks like the trajectory in many of these other west coast cities are on a similar sort of path. I wouldn’t call it a bubble, but it sure looks like we’re getting to the point where it becomes something important to keep on the radar.

More interestingly, this isn’t a national phenomenon. The national composite housing price index is still over 20% below the peak and the trajectory of price increase is far more subdued. In fact, many markets like New York, Las Vegas, Phoenix and other typical “bubble” era markets are still as much as 50% below their bubble peaks and showing relatively little signs of bubbly prices. So this is certainly not a national problem and looks to be more of a case of regional west coast frothiness.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.