Indexing is the new stock picking. It is, by far, the most efficient way to obtain a low cost and diversified portfolio. So it makes sense that index funds are gobbling up the financial markets. But this has some people concerned – what will happen when indexing gets so large that it becomes “the market”? Will prices become less efficient? Will the market become a homogeneous basket of single prices?

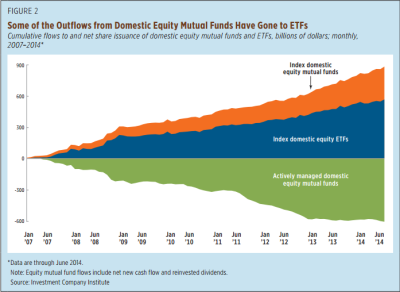

This is one of those messy myths that is derived from the “active” vs “passive” myth. People think of indexing as buying the whole market and then assume that, if everyone just buys the whole market, then “the market” will become one fixed set of prices that is set passively. This is compounded by the idea that “active management” is on the decline relative to indexing. Unfortunately, graphs like the one below are derived from studies referencing mutual funds as being representative of the active part of the financial markets. This is not accurate at all. And as regulars know, I find the distinction between active and passive to be largely useless in a world where we are all becoming low cost asset picking indexers.

The market is not one homogenous “index”. It is comprised of thousands of different indexes inside of “the market”. If we think of “the market” as all outstanding financial assets then there are literally thousands of different index funds tracking different strategies, different asset class weightings, etc. These indexes are regularly changing and adapting to market conditions (literally, every second). They are not one fixed basket of assets. So, think of thousands of different baskets all trading all day every day. Indexing actually isn’t very passive at all. It is, by definition, a very active thing under the surface. But to understand how the growth of index funds impacts prices you have to look at the underlying fund structure to understand how prices are set.

When an ETF is trading there is always a market price for the ETF (the price you see) as well as an intraday indicative value (the price the authorized participants see). If the market price were to deviate from the IIV then the market makers would either buy/sell the ETF or buy/sell the underlying securities. This means that indexing, by definition, creates the need for active management. There is no meaningful distinction because your purchase of an ETF could very likely result in some form of active management that you are, in some form or another, incurring the cost of (either the opportunity cost, spread cost, etc). In other words, indexing leads to active management. To make a distinction there is to look at only the surface level of the transaction. It’s like being in knee deep water and claiming to be “dry” because your upper body is not “wet”. This makes very little sense in the aggregate.

To summarize:

- The rise of indexing does not create one homogenous basket of assets. In fact, as indexing grows in popularity we are seeing an increasing degree of complexity and diversity in the types of outstanding index funds. Indexing has become the new stock picking. And instead of picking individual components investors are now conveniently picking diversified baskets inside of the global aggregate.

- The management of an index necessarily requires an active underlying component. Your choice to index is an active decision that will necessarily lead to some underlying market making activity. In essence, your laziness in buying all 500 components of the S&P 500 leads someone else to be that much less lazy. The trade-off in exchange for your relatively inactive approach is that you incur some frictions in the form of opportunity cost, spread cost or other costs. These are marginal at the user level, but in the grand scheme of things can and do lead to big time profits for the underlying market makers (that share of the “active” market is certainly not going away). The point is, the transaction of indexing, full circle, is necessarily active even if, at the user level, it appears “passive”.

- If everyone indexed it would mean there is that much more market making to be done by the authorized participants. Your decision not to pick stocks could necessarily lead to some institution buying/selling the underlying securities.

So, don’t get too concerned about the potential that index funds are going to eat the world. Index funds and active management are one and the same. That is how their product structure is designed. It can be no other way. To say that one can exist without the other is to misunderstand their symbiotic relationship. Unfortunately, the myth of passive investing has created a distinction where there really is none which leads to all sorts of unnecessary confusion.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.