Barry Ritholtz has a very good piece on Bloomberg today about investing lessons and March Madness. I doubt Barry and I are terribly far apart on this issue, but I did want to touch on one topic – predicting the future. Barry writes:

Predicting the future is impossible: The defeat of several favorites, most notably Kansas and Maryland, remind us that predicting the future is a fool’s errand. We simply never know what will happen next. It is as true for sports as it is for politics, investing or economics.

Chaos theory teaches us that these systems are complex, dynamic, non-linear and sensitive to small changes. The slightest unanticipated flap of a butterfly wing lays waste to the most thoroughly researched forecasts.

Only after you have accepted that you really don’t know what is coming next, can you begin to make more intelligent investing decisions.

This does’t compute for me. After all, predicting the future is actually pretty easy in a macro sense. For instance, anyone with a sound understanding of macroeconomics and the capital structure knows, with a very high probability, that stocks will tend to become more valuable over long periods of time because stocks reflect the value of some portion of our overall output. If you believe that people tend to become more productive, that populations will grow and you can avoid reading scary websites that predict the end of the world then the increasing value of corporations becomes a rather obvious fact over long periods of time. You don’t need a crystal ball to understand this. You just need some common sense.

Importantly, this isn’t about knowing what will happen. It’s about understanding the world for what it is and applying some reasonably high probability outcomes to certain events. I know, with a high probability that stocks will tend to become more valuable over the long-term because I know that human beings tend to become more productive over the long-term. Of course, we don’t invest in a “long-term” world all the time. In fact, most of us don’t really have a textbook “long-term”. As Keynes once said:

“this long run is a misleading guide to current affairs. In the long run we are all dead. Economists set themselves too easy, too useless a task, if in tempestuous seasons they can only tell us, that when the storm is long past, the ocean is flat again.”

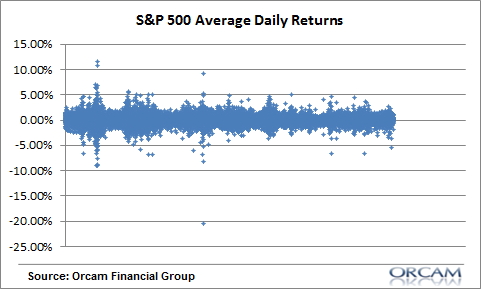

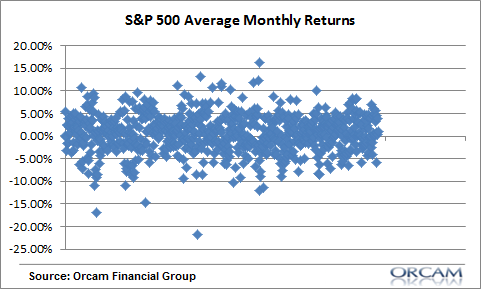

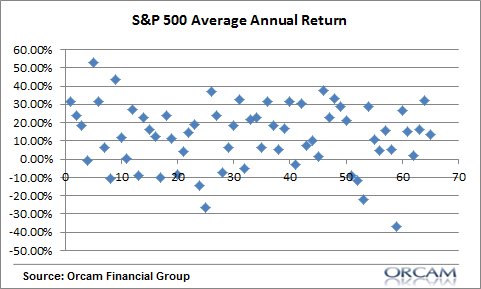

Saying that stocks will tend to rise over the long-term is not nearly as useful as some might think because our financial lives are a series of short-terms inside of a long-term. In other words, our investment time horizons tend to be multi-temporal. This forces us to think in some version of the “short-term”. And this is where predicting the future gets difficult. After all, over short periods of time the fluctuations of the market become increasingly random. For instance, if we look at the daily, monthly and annual returns of the S&P 500 over the last 60 years we can see just how much time impacts our portfolio outcomes.

In the very short-term, the stock market is almost entirely random with daily fluctuations averaging just 0.03%:

On a monthly basis the average return skews marginally positive to 0.7%, but still appears to be largely random:

Over an annual basis the average return jumps significantly to almost 13%. The returns still appear somewhat random, but they have a significant positive skew:

Increasing your time horizon reduces the randomness of the stock market’s negative performance because what you’re really doing is improving the odds that your portfolio’s performance will correlate with broader corporate output. So, it’s not really about not being able to predict the future. It’s about understanding how the world works and then applying high probability outcomes to future events. This is not about “knowing nothing” or avoiding predictions. It is very much the opposite. I would argue that the more you know the greater the probability that you will make high probability predictions about the future.

Of course, smart investors also know their own limitations. They know the limits of concepts like “the long-term”. They know the arithmetic of the market and the importance of reducing taxes and fees. They understand the futility of trying to “beat the market”. And they know that the stock market isn’t where you get rich. As GI Joe taught me many moons ago, knowing is half the battle. The other half is applying your knowledge in a manner that is likely to result in a high probability of you meeting your financial goals.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.