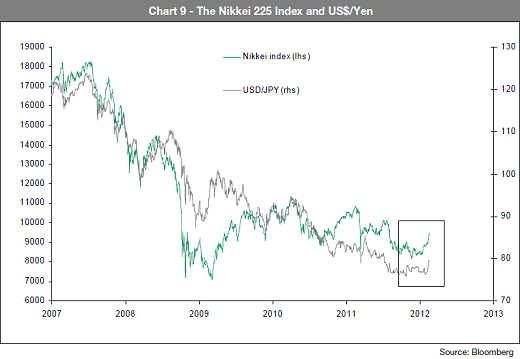

There has long been a strong correlation between the Nikkei and the US Dollar/Yen. A similar version of this correlation is that of the Nikkei and US interest rates. The thinking is rather simple. As a trade surplus nation the rising Yen puts downward pressure on profits and Japanese equities. Unfortunately, the calls for a bottom in the USD/Yen have been made for years on end. But Credit Agricole thinks the time could be now and that that’s bullish for Japanese equities, This argument would be reinforced if one believes interest rates in the USA are bottoming (which, if you take the Fed’s 2014 forecast seriously means Credit Agricole might be right in the short-term, but is wrong in the longer-term):

“Our argument is different. If the story of the rebalancing of growth – with an inflationary bias – within the global US$ area is as powerful as we suspect then the greatest potential beneficiaries should be ultimately the most distressed parts of the world equity landscape. The world’s cheapest major equity zone is the euro area – and Japan.

It is time to reassess Japan, once again. The Bank of Japan has just announced an unexpected supplement of quantitative easing of a rather more authentic kind than that practised by the ECB. But nobody seems excited, because it’s Japan, and everybody thinks that it has all been attempted before without success.* However, the context has become more favourable to the Japanese stock market: policy relaxation in the emerging world, a more stable US$ and improved expectations for global growth.

The point is that there is a tangible catalyst for the revival of Japanese equities: the exchange rate. If the “end of reflation” in America really does imply a more stable US currency then, sooner or later, the downward trend in US$/Yen will reverse. We suspect that this is what we are witnessing. We will have the confirmation when the US$ trades above Yen 81/82.”

I don’t know if I agree there. For years now I have discussed the fact that Japan is encountering a demographic trend that is highly problematic. That makes the macro trends in their economy extremely difficult to feel bullish about. I say stay out of Japan and focus on other markets. The Nikkei is like dealing with a penny stock in a world of high quality options. If you want to gamble you’re better off in Vegas where the drinks are free while you flip coins.

Source: Credit Agricole

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.