In a past life I was a financial advisor. And while I no longer perform the duties of a financial advisor I haven’t forgotten what it takes to offer sound financial advice on a broad array of topics. One topic that I often get questions about is the purchase of a home. “Is now the time to buy a house?” “Should I rent or buy?” “Should I invest in real estate?” I’ll lay out some of my general thinking here so readers can better answer these important questions.

In a WSJ article last week Gary Shilling and Eric Lascelles answered an important question: “Is now the time to buy your first house?” Shilling argued that inventories were still too high and would put downward pressure on real estate prices likely resulting in a further 20% decline in national prices. This is consistent with the historical average as seen in Robert Shiller’s inflation adjusted house price index. Lascelles, on the other hand, argued that housing was very affordable based on several affordability metrics and that purchasing a home in this environment will prove a steal.

My opinion sort of agrees with both men. Now, I’ve been a big bear on real estate for a long time now. I used to get in blow out arguments with my mother over the price of real estate back in 2005 and 2006. In a 2006 client letter I said:

“The credit driven housing bubble remains the greatest risk to the equity markets at this time.”

In early 2010 I said prices would likely decline another 7-15%:

“As I said above, the most likely scenario is the “work-out”. Government stimulus continues to bolster the private sector in the back half of 2010, but the lack of direct aid in housing begins to weigh on the housing market in the second half of 2010. Negative seasonal trends make for a very difficult H2 in housing and a tough start in 2011. The economy appears fairly strong into the latter portion of 2010, but the dwindling stimulus ultimately pressures the private sector. Demand for housing remains tepid as job growth is weak, the unemployment rate remains above 8% into 2011 and the negative inventory trends prove too much for the real estate market to overcome. Ultimately, prices decline 7%-15% over the course of the coming 2.5 years.”

Prices are down exactly 7% since then so it’s time for an update. While I am not a raging bull on housing I am also no longer a raging bear. I am rather neutral now.

First, I think Shilling is potentially right to a certain degree. There probably is more downside in some real estate markets. But I don’t think there’s 20% more downside in national prices. Instead, I think we’re likely to muddle through from here with a classic post-bubble “work out” period. I recently described why I think this is likely:

“If we take a step back and look at some longer-term data we can put this in perspective though. I like using the Shiller CPI adjusted housing price data as well as the owner equivalent rent data from the monthly CPI reports. These two charts will help put the declines in perspective. As you can see below we’ve made significant progress in the mean reversion process. According to both indicators housing prices are overpriced by roughly 15%. This likely means there is more downside risk in the coming years, but the bulk of the declines are definitely behind us.

I think the more likely scenario is the standard post-bubble work out period where prices will not “bottom” (as many have called for), but will rather flat-line for many years. Pull up a chart of the Nasdaq or Nikkei or Shanghai or any other number of bubbles if you’re trying to imagine what I am referring to. What would be HIGHLY unusual is for prices to snap-back or “bottom” in a dramatic event process that leads to a surge. Rather, we’re far more likely to see the high inventories work off slowly while prices moderate and incomes grow to bring the market back to some semblance of normalcy.”

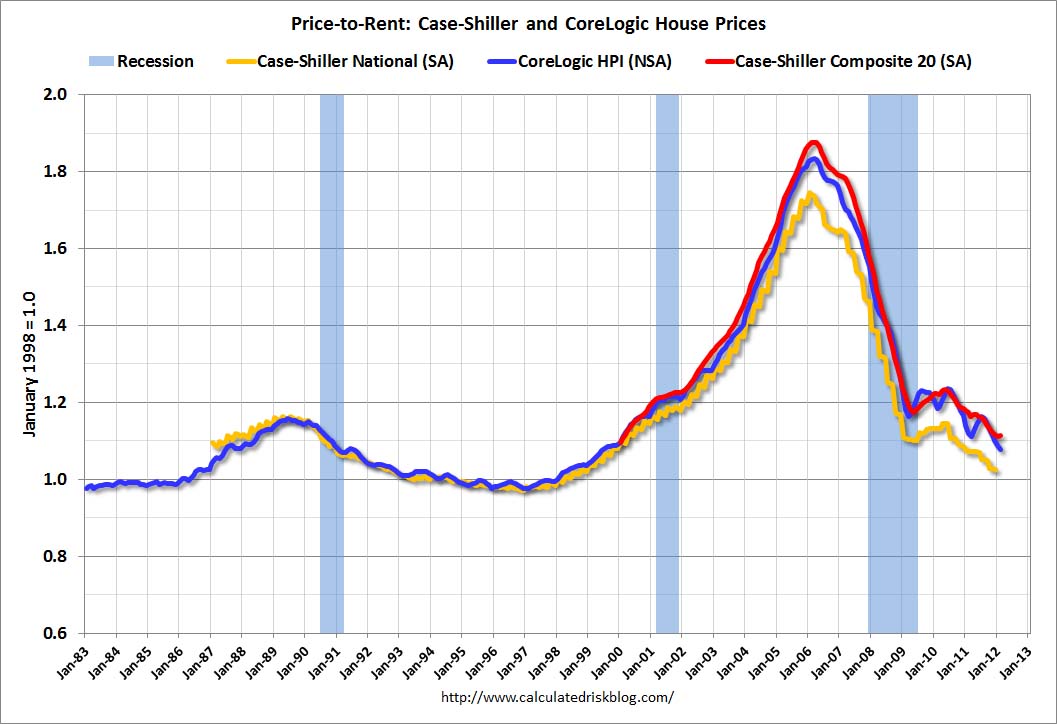

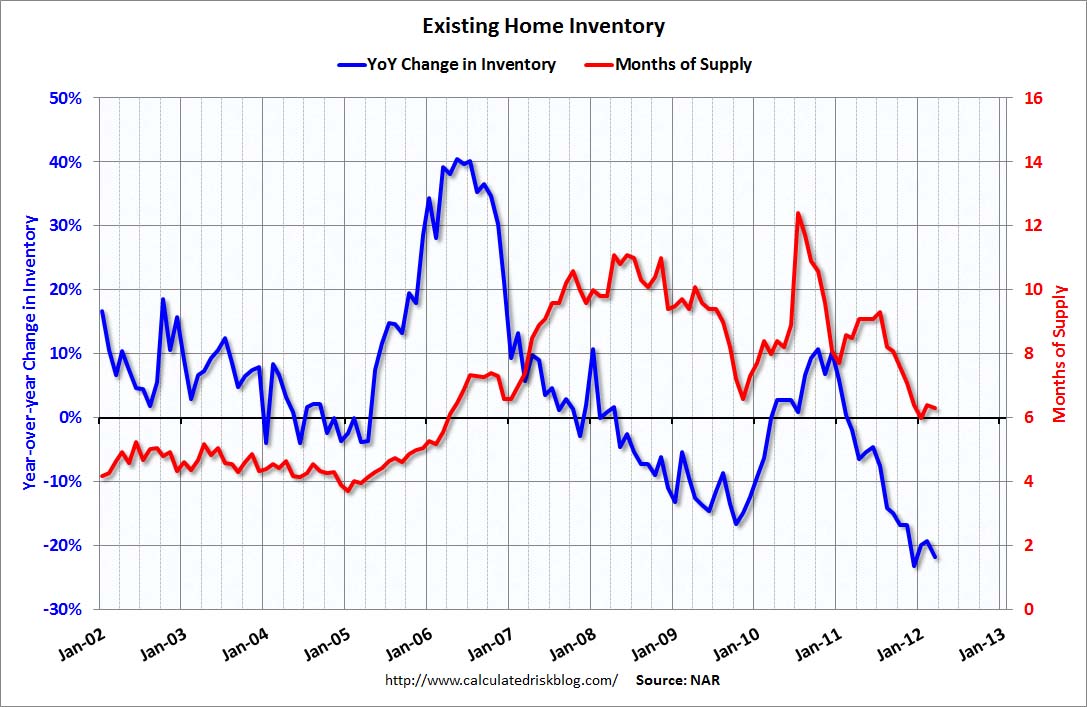

So my guess is Shilling’s prediction for 20% downside and a possible overshoot further is extreme. As Lascelles argued prices have become much more affordable in many areas, inventories are coming way down and the price to rent is back to very reasonable levels. Calculated Risk has some update charts here:

(Price to rent)

(Existing home inventory)

All of this adds up to one thing. Real estate is far more attractive than it was at any point in the last 8 years or so. Has it bottomed? That’s the wrong question in my opinion. Real estate likely won’t crater from here, but also won’t skyrocket. “Bottoms” (as in an event bottom) are very unusual after a bubble like we’ve seen. The standard post-bubble “work out” period is the most likely scenario so prices could be flattish for years. So do you buy now, rent, invest? First, I don’t think the average retail investor should bother with investing in real estate. Real estate investing is a full-time job and requires a great deal of hands on involvement to actually turn a consistent profit above the rate of inflation over any sustained period. When you buy a house you should think of it as a roof over your head and a place where you will LIVE. Not an investment. And this is the key. If you’re planning on living in a house (as in, 10 years of actually living in a home) then you should have no great fears about buying today. Does that mean you’ll make money on it? Or that it will prove more beneficial than renting? Well, that depends on a lot of personal variables. But the base case here for national real estate is that the risk/reward of buying a home has changed substantially and is no longer skewed to the bear case.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.