In this September 2010 study a German military think tank analyzes how “peak oil” could impact the world in the coming years. They discuss the importance of oil to the global economy, its connection to global conflicts and why the world is almost certainly running out of this important resource:

It is a fact, however, that oil is finite and that there is a peak oil. Since this study is mainly focused on understanding cause-effect relations following such a peak oil situation, it is not necessary to specify a precise point in time. Some institutions claim that peak oil will occur as early as around 2010. Depending on the development of globally relevant factors, we cannot rule out that peak oil could have serious security policy implications within the review period of the 30-year investigation perspective chosen for the SFT series. The dimension of the potential effects in conjunction with the above-mentioned ambiguity regarding the existing data on the future availability of oil therefore underpins the necessity to look in more detail at

the potential security policy implications for Germany.Apart from the above-mentioned uncertainty factors regarding exact peak oil occurrence, it is foreseeable that when global peak oil is actually reached – and if transformation towards post-fossil societies has not been extensive enough or has occurred too late – it will no longer be possible from a certain point to cover the global demand for oil. Against this background and regarding the long periods of time needed for adjustments in the energy sector aiming at a far-reaching energy transition, it is today’s necessity (1) to thoroughly analyse our extent of oil dependence, (2) to identify – based on this information and in time- potential risks , and (3) to discuss alternatives for using oil.

…The main objective of the study is to raise awareness about the systemic importance of oil and, in turn, the derivable significance to security policy if peak oil is exceeded. The findings and results are expressly not meant to imply that resources will necessarily have to be secured with military assets. Rather, the study is to be understood as an appeal to think things through at an early stage and to develop both preventive and responsive courses of action. It does not aim at anticipating political decisions.

#1 What Does Peak Oil Mean?

“Peak oil” denominates the maximum oil production. It is the point in time when the production rate of a single oil field or of an entire producing region has reached its absolute maximum. This is usually the case when approximately 50% of the recoverable oil has been extracted. In order to predict global peak oil, it is necessary amongst other things to estimate how much recoverable oil, including newly discovered deposits, is available and how much, over time, can be produced per day. Using his own calculations as a basis, the US geoscientist Marion King Hubbert claimed as far back as the 1950s that the total production of several oil sources would form a curve resembling the shape of a bell – the Hubbert curve.

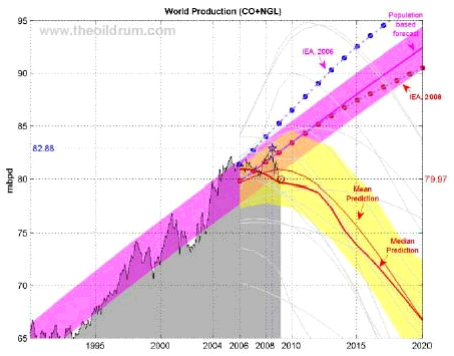

Source: www.theoildrum.com

The grey area in Figure 8 shows the world-wide production of oil. The diagram shows a mean and a median prediction of 15 peak oil studies, all of which forecast that the peak will be reached before 2020. The variability of these predictions is shown by the yellow area. The magenta-coloured area represents a population-based model of the International Energy Agency (IEA), which assumes that oil production will grow in relation to the population. Peak oil critics, in particularly the IEA itself, assume that the grey curve will remain congruent with the magenta-coloured population-based predictions and that there will therefore be no unanticipated shortages. Peak oil advocates believe that the grey area will develop within the yellow zone.

The general explanation for the existence of peak oil is the fact that fossil resources are finite. Most of the oil produced today comes from conventional oil reserves.210 Conventional oil, however, is only available to a limited extent, because it is a finite natural resource. There is therefore no dispute that there will be a “depletion point” – at least when it comes to conventional oil. Nobody knows for certain how peak oil will take course, however. A possible initial scenario, for example, would be a prolonged plateau of oil production, a stagnant global production rate. It is suspected that increasing oil prices could result in more investments being made in recovery systems, new recovery techniques, oil substitutes and energy-saving technologies. Technical progress also has its limits, however, for example if there is not enough time available for research.”

This is something I certainly don’t discuss enough here on the site and as a macro theorist that is inexcusable. Oil’s importance to the global economy has come to the forefront in the last few years and studies such as this one help to shed light on the potential problems that could result. I highly recommend reading the entire study here.

* Thanks to Tom Hickey for posting this originally.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.