Despite the weakening global economy the Fed showed no signs at the most recent FOMC meeting of planning QE3. Markets didn’t take kindly to the news and promptly sold off. But that doesn’t mean QE3 isn’t in the cards. In fact, I think it’s likely to become a topic of debate in the first quarter of next year and becomes a high probability event by the end of Q2.

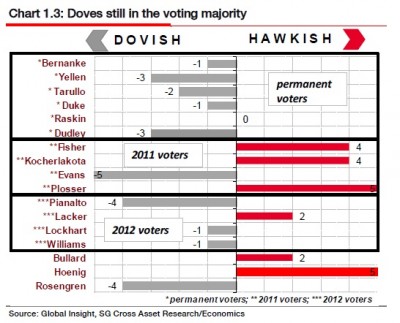

In a story last week FT Alphaville highlighted the fact that the Fed is increasingly dovish and likely to move towards an accommodative stance early next year:

“But there will be much talk about what might be done in the first quarter of next year, possibly as soon as the next meeting in January — and by then, Bernanke will find the company more amenable to looser policy, should he choose to pursue it. Non-voting hawkish Fed presidents can still make a lot of noise, of course, but on the FOMC itself the composition will clearly shift the other way.

A chart from SocGen, which mostly reflects our understanding of the members’ positions, though the bank doesn’t share its methodology:”

The more important element here is the status of inflation. The Fed has been quite clear that they’re not entirely comfortable with 2% core inflation. This is at the higher end of their targeted range and leaves them unlikely to take further action if they believe it could contribute to higher inflation. But the kicker in the story is that we’re beginning to see signs that inflation could be peaking and if commodity prices continue their downward trajectory it would not be surprising to see the Fed feel more comfortable taking action.

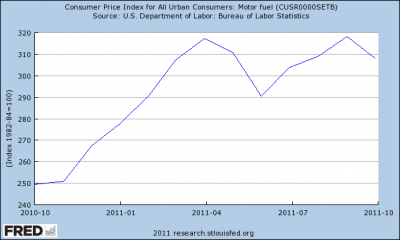

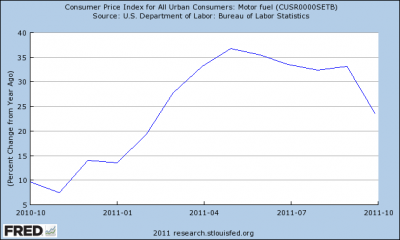

The key to the inflation story in recent years has been the motor fuel component. As the St. Louis fed noted early this year (see here), motor fuel is contributing unusually to the higher than comfortable inflation. As you can see in the charts below the comps become increasingly difficult in April of 2012:

Motor Fuel CPI

Motor Fuel YoY% Change

With the comps becoming increasingly difficult in April 2012 we’re likely to see disinflationary trends in core CPI around this time and perhaps before. The FOMC meets early next year at the following dates:

The March and April meetings probably won’t occur in time for the Fed (a notoriously reactive entity) to become comfortable with core CPI rates. But the discussions will almost certainly be on the table in Q1. There’s some chance the Fed is proactive at the April meeting, but it’s not something I’d bet on. Instead, if you’re looking for QE3 the odds likely point to the June 2012 meeting. Of course, there are a lot of moving parts here, but if you’re a betting man or woman the likelihood of QE3 in Q1 next year looks low to me. The odds are substantially higher in April and June of 2012 when the FOMC meets.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.