If you’re familiar with my philosophy on “investing” you know that I actually hate that word in its most common usage. Investing is spending for future production. When most of us buy assets on a secondary market such as a stock exchange we’re not actually “investing” at all. We are simply allocating our savings into assets that have already been issued to finance real investment. Therefore, the secondary markets are just a place where we allocate our savings hopefully in a way that gives us access to various income streams so we can diversify our personal assets and protect ourselves from the risk of purchasing power loss and the risk of permanent loss. Therefore, calling the act of buying a stock on a secondary market “investing” is a bit misleading.

But most of the world doesn’t see things this way. We have been overrun by a short-term perspective of the markets where traders think they can “get rich quick” by buying the next hot stock or “beating the market”. These are false pursuits in my opinion that are based largely on misunderstandings of the financial system. The stock market isn’t where you get rich or make your real investments. And if you agree with my views then the allocation of saving necessarily becomes a longer-term pursuit. Not too long of course – the idea of “stocks for the long-run” or the concept of the “long-term” as touted by many financial pundits can be just as dangerous as short-termism and can lead to a false sense of security in owning high risk assets. So the truth, as is usually the case, lies somewhere in the middle.

But a funny thing is occurring as technology expands and we become better informed about our surrounding financial world. Technology appears to be feeding on this “get rich quick” mentality and it seems to be hurting many investors or leading them into a new form of high fee automation that adds little value.

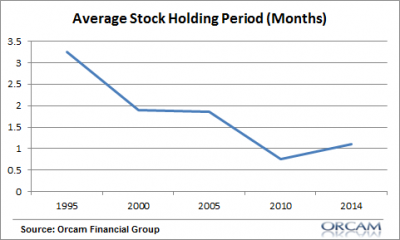

In the last 20 years the average holding period of a stock has fallen dramatically from over 3 months to just over 1 month:

This is actually down tremendously from 1940 when the average holding period was 7 years! It seems that as technology makes the secondary markets more readily accessible the short-termism of investors is increasing. If we look at some of the hottest new “financial firms” we see companies like Robinhood and the RoboAdvisors popping up everywhere. Robinhood is a firm that allows you to trade for free from your mobile phone. And the RoboAdvisors allow almost anyone to invest in an automated “passive” portfolio service for a low fee.

But I have to wonder if all of this is actually good? I am not generally one to shun technology and I don’t want to generalize here. After all, the fact that the little guy has access at all to the secondary markets is a fabulous advancement. But I do wonder how positive many of these technological advancements are. Let’s be honest, virtually no one should be trading their account every day or engaging in the type of market timing that companies like RobinHood rely on. On the RoboAdvisor front, I still can’t see the value add in the approach – yes, it’s great to automate your approach, but much of what they do just looks like another way to layer on extra fees for something you can easily do on your own. So it makes me wonder – as technology eats the financial world are we actually better off or is it just feeding on the same old myths and misconceptions that help financial firms line their pockets in newer and more innovative ways?

Related:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.