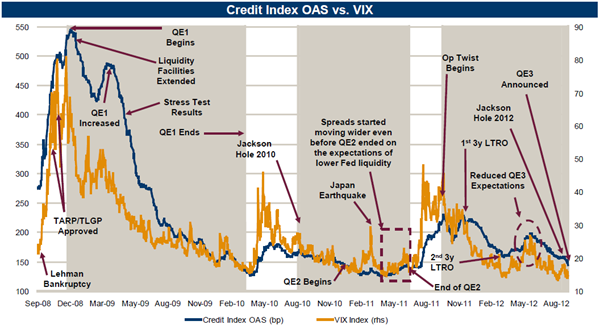

Here’s a really interesting chart via Also Sprach Analyst showing the implementation of the various QE programs and market stresses. The chart shows the Credit OAX Index as well as the VIX. These are two well known stress indicators that spike when the markets are under duress. QE1 and QE2 were implemented on the back of extreme market stresses. Of course we all know what happened in 2008 and then the 2010 QE implementation came on the back of the Flash Crash and the spiraling of the Euro debt crisis.

But what’s most interesting to me is that the Fed has implemented the policy with the hopes of generating a “wealth effect” in the markets by pushing various asset prices higher with the hopes that this will create a virtuous cycle of people feeling wealthier, spending more and generating recovery. I think that strategy puts the cart before the horse, but let’s say it actually works. When would be the ideal time to implement such a strategy?

If you’re a grizzled market veteran you know that the best time to buy is when you need to plug your nose, dive in the cesspool, grab what you can and make it out alive. Or even someone with a basic investment education is likely to adhere to the old saying “buy low and sell high” (often easier said than done). And indeed, that’s what the Fed did in both QE1 and QE2. QE1 was implemented on the heels of the horrifying crash of 2008 with the market near its lows. And QE2 was implemented on the heels of a 20%+ summer decline that included various Euro scares and the Flash Crash. But this time, the Fed implemented QE3 AFTER a 15% market rally and few signs of stress in many market indicators.

So the question one might have to ask themselves is – did the Fed just buy high only to inevitably sell low? I guess only time will tell….

Source: Barclays

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.