There have been some positive signs in the labor market in recent weeks despite persistent fears over imminent recession and global economic slow-down. While it would certainly be a stretch to say that the jobs market is set for a big boom, it’s becoming clear what’s NOT happening – the labor market is not currently forecasting any sort of major economic slow-down or collapse. This is crystal clear from a few of the more time sensitive indicators.

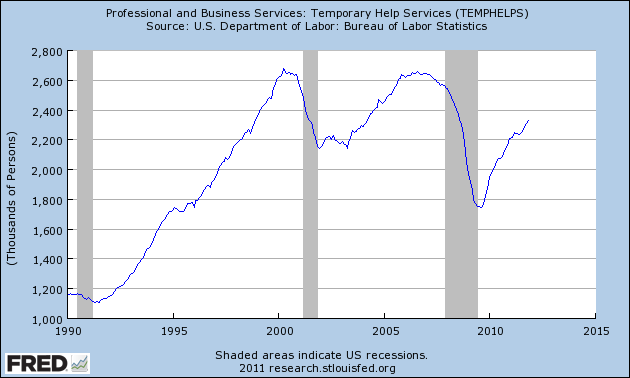

Temporary help services, a leading indicator of the labor market and economic contraction, have remained in steady expansion mode into the month of November:

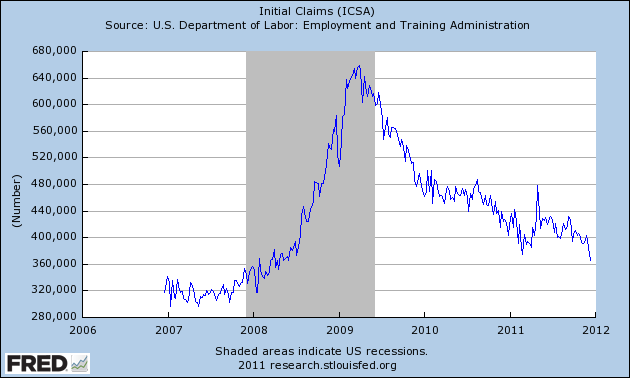

Initial claims, which we see on a weekly basis, are in a clear downtrend:

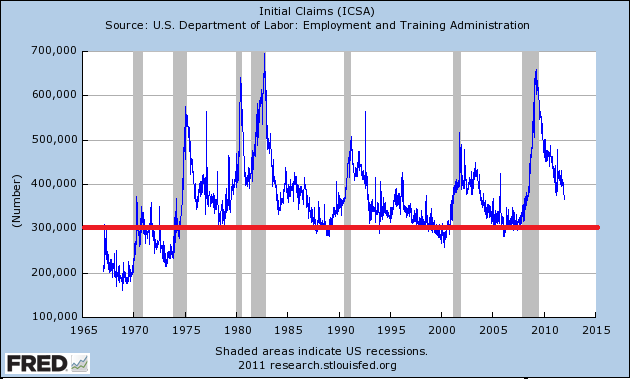

Out of the 7 recessions since 1965 none has been preceded by initial claims above 305K. This represents the enormous slack in the economy. Another way of thinking about this is sort of like claiming that a boxer can get knocked down when he’s already flat on his back. There is so much slack in the economy currently that a new recession would be the equivalent of literally getting knocked out again while being flat on your back. Not impossible I guess, but unusual to say the least:

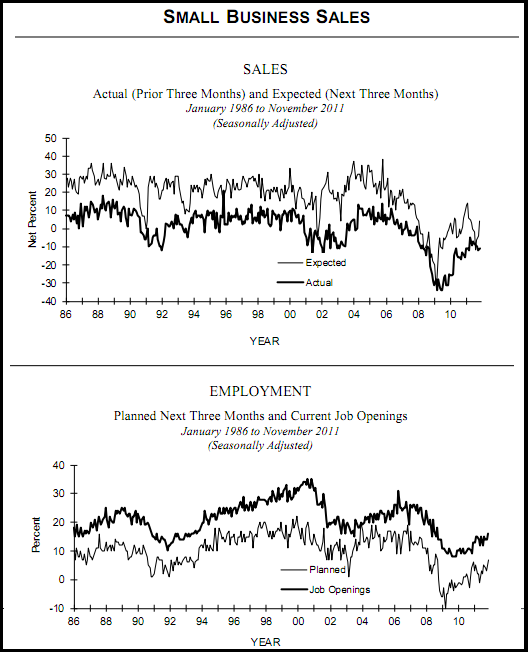

The most bullish jobs data point in recent months is probably the NFIB small business survey. Their November survey showed renewed optimism in SALES. As regulars know, the balance sheet recession is all about end demand. Why? Because sales are all about demand and increased demand leads to increased revenues which leads to corporate hiring. As I’ve recently highlighted, the #1 concern keeping businesses from hiring is not regulation or taxes or uncertainty. It is sales!

Small businesses are the most important component of the labor market and the weakness in small business has been crucial to the weak labor market. The latest survey showed the highest level of optimism regarding hiring since the recession began in 2008. It’s not surprising that expected sales are surging while hiring plans are increasing:

I don’t want to blow things out of proportion here, but this data points to one clear conclusion – the labor market is most certainly not collapsing. And while it requires a huge amount of jobs improvement to close the output gap and bring down the real rate of unemployment (a boom that’s not likely given the continuing balance sheet recession), it’s clear that the time sensitive indicators are pointing to improvement in the labor market. Baby steps….

Update – Reader Kyle notes that the 82 recession did indeed begin with claims at an unusually high level. Sorry for overlooking this. So I guess I should have stated that the odds of recession, given that only 1 of the 7 has started with this much slack in the labor market, is not great odds, but HAS most certainly occurred before….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.