The world used to abide by the saying “when America sneezes the world catches a cold”. But after a lost decade in the USA that saying has come under fire and rightfully so. But an interesting thing is occurring as Europe catches a cold. America isn’t even sniffling. Some economists claim there is no way the USA can escape the downturn now being seen across Europe. I’m not so sure this is correct.

There has been one very clear difference in Europe and the USA over the last few years. Although both regions have suffered from balance sheet recessions and sizable real estate bubbles (some parts of Europe more than others) the response has been entirely different. Europe, as a result of the flawed single currency and lack of political unity has imposed austerity on itself for the better part of the last few years. In many countries this has resulted in an environment that never even remotely resembled the recovery seen in other parts of the developed world. In fact, many of these countries are in full blown depressions.

The United States, on the other hand, has been running steady 10% budget deficits throughout the last 3 years – there has been no real austerity. This has helped the private sector de-leverage without crushing economic growth. I’ve maintained an unpopular position over the last few quarters that the USA would “muddle through” as opposed to falling into recession. This position has been based on my idea of a continuing balance sheet recession in the USA combined with a government that, despite its inability to agree on most things, has not torpedoed the economy via austerity.

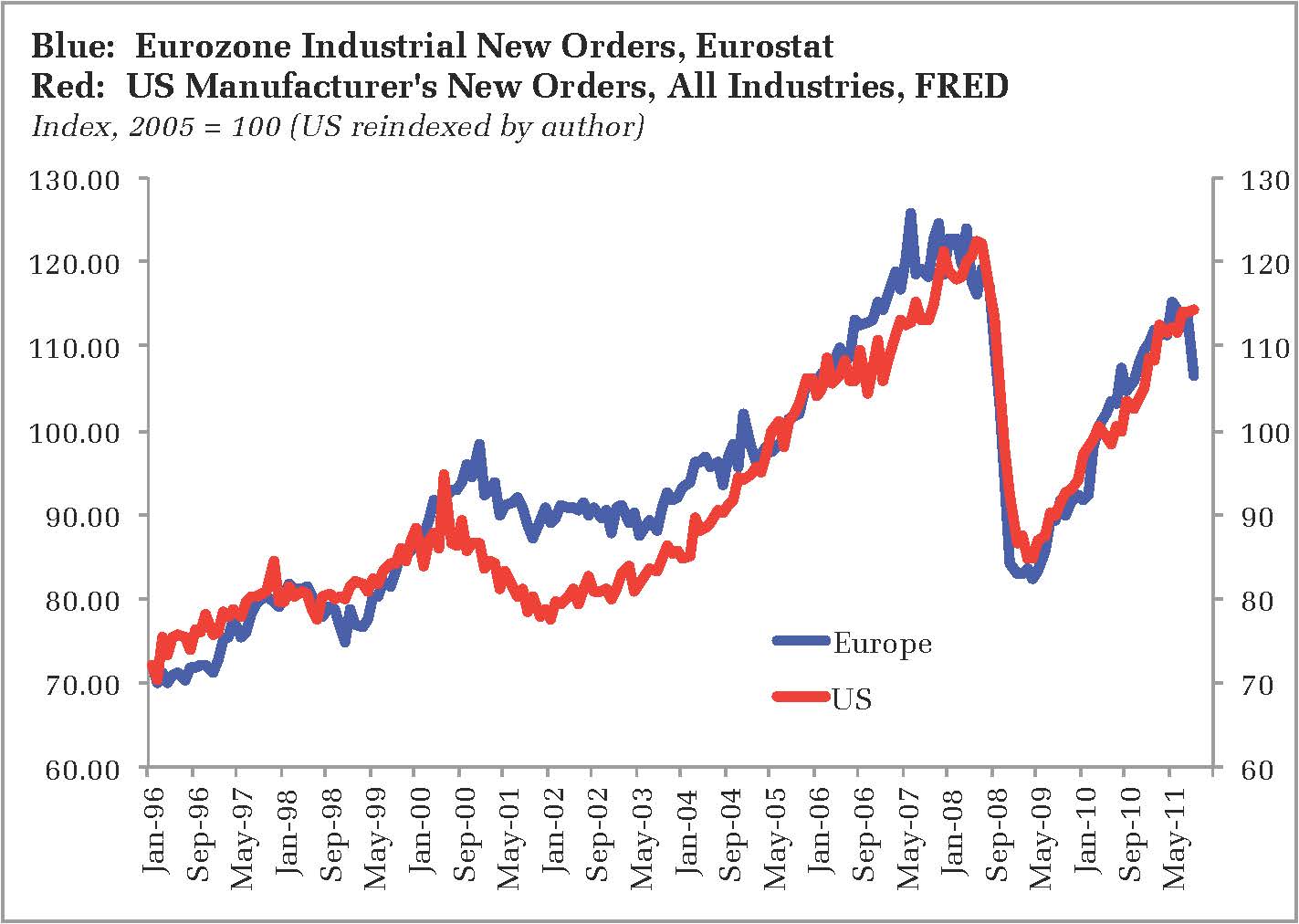

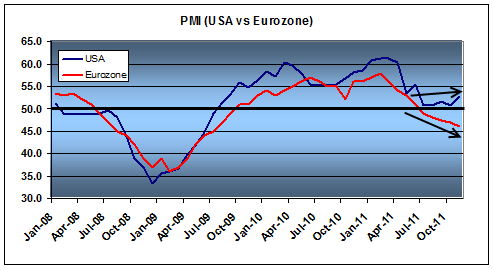

The latest PMI and industrial new orders data shows the divergence that has appeared in these two regions over the last few quarters:

Based on the PMI data, the Eurozone has been contracting for two quarters while the USA continues to muddle through:

I think it’s too early to break out the victory cigars and proclaim that the United States has avoided a double dip. As I’ve long maintained, trying to forecast the double dip misses the bigger point that the USA is still very much in one long recession – a balance sheet recession (no victory cigars for that). It’s just been offset by continuing government spending. The difference in Europe is that austerity has exposed the balance sheet recession for what it really is.

So, while the USA isn’t out of the woods in terms of a double dip I do think it’s safe to say that, given the 2012 budget projection of 10% deficits, any downturn in the USA is likely to be meager compared to the disaster that is Europe. One thing is for certain – despite continual bickering in Congress, the lack of austerity during a balance sheet recession makes American politicians appear infinitely more capable than the political mess now unfolding across the pond….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.