I’ve argued now, for longer than I wish, that we are in a secular bear market driven by global imbalances. While rallies are sure to ensue during the secular bear it’s important to understand that a secular bear generally doesn’t end with a few bailouts and a return to the good old days (think 2003-2007). Secular bears end when the excesses that caused the prior bull are extinguished. In our predicament, it’s impossible to make the case that this is currently true. The flawed Euro currency continues to wreak havoc throughout the region. The flawed Chinese currency peg continues to impose imbalances on the global economy. And the financalization of the global economy continues to infect the entire system – primarily the United States.

Although we’ve kicked the can I think it’s fairly safe to say that nothing has really changed since March 2009. We’ve merely papered over the bigger problems. This doesn’t mean things haven’t gotten better. They have. And I fully recognize that we could be experiencing a repeat of the 2003-2007 period when equity markets were generally positive, but global excesses largely remained. At some point, however, these problems must be dealt with head on. The debt must be removed, the Euro must be fixed, the Chinese must work to fix their imbalances and the United States needs to stop with policies that promote imbalances within its own economy.

When will this all occur? It’s impossible to say. It’s clear that Ben Bernanke and the US government have no desire to give up on the Milton Friedman/Alan Greenspan playbook that got us into this mess. The Europeans are making solid progress towards resolving the Euro crisis, however, the flaws largely remain. And the Chinese are beginning to discover through inflation that they have created their own imbalances. My guess is that one of these problems will cause a more pronounced problem in the global economy in the coming years and force real change. When will that occur? Probably not until government’s recognize the gravity of the situation and work towards actually fixing the problems as opposed to papering them over. That might involve some pain and we all know governments are now convinced that you can have capitalism without pain. But as Kyle Bass says, capitalism without losers is like Catholicism without hell.

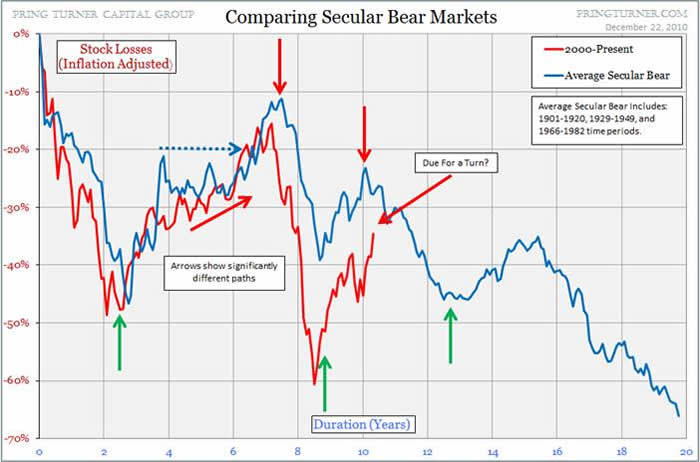

Pring Turner Capital Group recently published the following commentary and excellent chart showing the average secular bear. It succinctly puts the average secular bear into perspective:

“If the current bear does follow the average path in a broad sense, our historical study suggests 2011 could be a challenging year. We are in no way predicting that a new down leg to the secular bear is about to get underway because that would require evidence of a new emerging cyclical bear and that is not yet on the table. What we are saying, is that confidence is still excessively high by traditional standards, valuations are still too expensive and therefore, investors need to be on alert for a resumption of the secular bear trend.”

While there is ample evidence of economic improvement in recent months I still believe there is zero evidence that the secular bear market has ended. This doesn’t mean there isn’t a great deal of money to be made during the bear market (on both the long and short side), but at some point we must recognize that our global imbalances all remain. Admission is the first step. We’re clearly not there yet.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.