This morning’s ISM Manufacturing report was better than expected at 51.6. The report overall was nothing to “ooh” and “ahh” about, but it’s generally consistent with a slowing and not a collapsing economy. I think this meshes with recent data rather well. Thus far the US economy continues to grow, but at an unacceptably low rate. The real risks right now appear to be more global, primarily Europe and Asia.

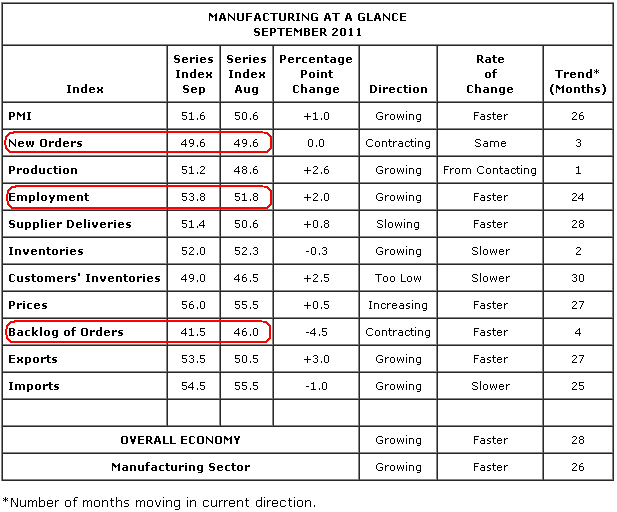

The good news in the ISM report is that employment continued to climb and the economy appears to be hanging in there. The bad news is that new orders and backlogs continued to contract. The even worse news is that a lot of this is likely to be lagging as global economic slow-down concerns really picked up in the latter portion of September. Therefore, this report may not be an entirely accurate reflection of what’s going on outside of the USA and the concerns that manufacturers are seeing. More details via ISM:

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. “The PMI registered 51.6 percent, an increase of 1 percentage point from August, indicating expansion in the manufacturing sector for the 26th consecutive month, at a slightly higher rate. The Production Index registered 51.2 percent, indicating a return to growth after contracting in August for the first time since May of 2009. The New Orders Index remained unchanged from August at 49.6 percent, indicating contraction for the third consecutive month. The Backlog of Orders Index decreased 4.5 percentage points to 41.5 percent, contracting for the fourth consecutive month and reaching its lowest level since April 2009, when it registered 40.5 percent. Comments from respondents generally reflect concern over the sluggish economy, political and policy uncertainty in Washington, and forecasts of ongoing high unemployment that will continue to put pressure on demand for manufactured products.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.