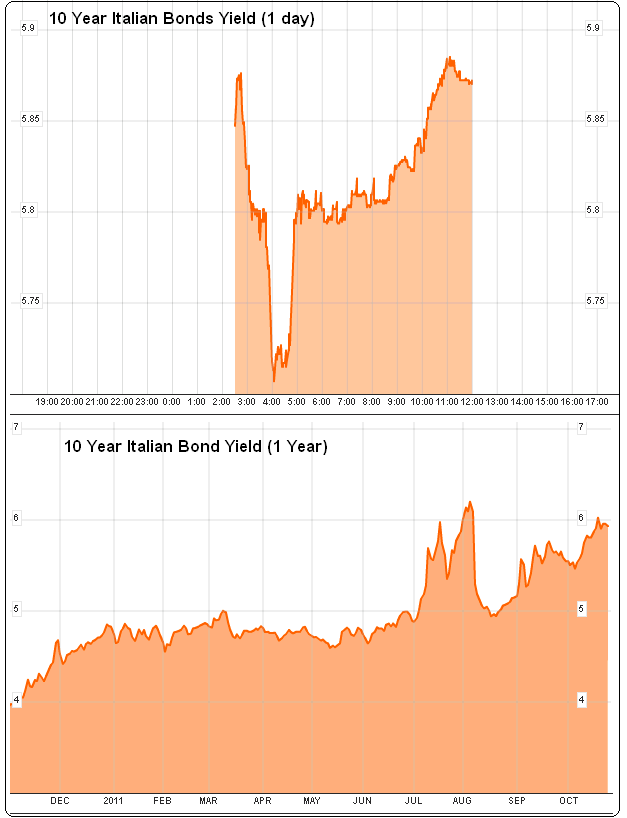

Equity markets are rightfully celebrating the fact that, in the near-term, a full blown banking crisis with private sector contagion has been avoided. But we shouldn’t get too far ahead of ourselves here. An interesting development in response to this Euro package is the Italian bond market. The bond vigilantes are shrugging their shoulders at this. As you can see in the chart below, yields on the 10 year Italian bond initially fell, but have since recovered all of their lost ground since the announcement last night. What’s going on here? Why are the equity markets responding so favorably while the bond market barely budges? I think the message from the Italian bond market is quite clear – this is not a real solution to the Euro crisis. Equity markets are more hyperbolic and looking at the near-term. One is saying, “the coast is clear for now” while the other market is saying “there is much work to be done here”.

Bond vigilantes in Greece have already learned the lesson from this crisis. The ECB’s current strategy cannot stop yields from surging in the case of worsening budgets. If the ECB wants to control the yields on these periphery debts they need to set the rate and be a willing buyer in any size at that rate. This would be a step towards fiscal union and unfortunately, the Germans won’t have that. They’d rather backstop their banks, impose austerity and hope that this crisis resolves itself. Wishful thinking if you ask me and the Italian bond vigilantes seem to agree.

The Italians have made bold targets for the coming months. It’s eerily reminiscent of the targets the Greeks have been setting for years now. Can they grow their economy during a balance sheet recession while the government sector contracts? The math says no and talk is cheap. The Greek experiment confirms this. Italian bond markets are shrugging their shoulders at this plan. While it may be a step in the right direction, it is by no means a real fix. The question now is how long before the bond vigilantes get impatient and force the EMU leaders into truly bold action?

Source: Bloomberg

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.