Back in 2008 I started discussing the idea of the household debt crisis. In early 2009 I read Richard Koo’s fantastic “Holygrail of macroeconomics” and ripped off the term “balance sheet recession” – the concept of weakness in the private sector due to de-leveraging which can only be offset by government budget deficits. And then I embedded Wynne Godley’s sector balances approach into this to provide an overall view of what was occurring in the US economy and why.

In short, the US economy had suffered a massive debt bubble which resulted in ruined balance sheets and debtors turning into savers. This lack of aggregate demand from the household sector was devastating as it caused a massive slump in private investment. Private investment fell an unprecedented -22% year over year in 2008. The worst post-war era slump in private investment had previously been -10%. This -22% collapse was devastating for the economy as it coincided with capitalists protecting their profit margins and bottom lines by disposing of their biggest cost – their workers. So the unemployment rate fired higher and the economy appeared well on its way to depression.

Then the government stepped in. In this sort of environment where the patient is having a heart attack, the government acts like an artificial heart firing blood through the system to keep it from dying. After all, an economy is just a system of flows, incomes, revenues, profits, etc. When the flow dies the system dies. But the government can ALWAYS tax and spend more. And that’s precisely what they did in 2009. That artificial heart was turned on overdrive. Some of the spending was good, some of it was bad. But what it most certainly did was shower the private sector with income that helped them pay down debts, repair balance sheets and avoid a full blown depression. In other words, the government’s deficit was the non-government’s surplus.

I’ve been describing this precise situation for years now. So I was pleasantly surprised to see this morning’s note from Jan Hatzius in which he embedded not only the sectoral balances, but also embedded the idea of the de-leveraging. This is the holy grail of understanding what’s happened to the US economy and why the private sector has been so weak. More importantly, it explains why the government stopped the US economy from looking more like Spain or Greece even though we’re suffering from the exact same disease.

Hatzius writes:

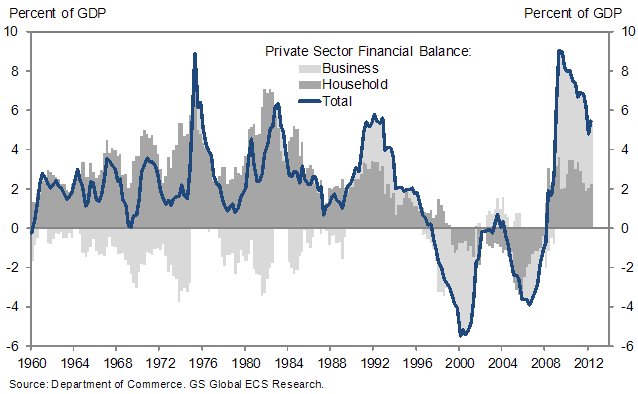

The US private sector continues to run a large financial surplus of 5.5% of GDP, more than 3 percentage points above the historical average. This is the flip side of the deleveraging of private sector balance sheet. We expect a normalization in this surplus over the next few years to provide a boost to real GDP growth. This is the key reason why we see US economic growth picking up gradually in the course of 2013 and into 2014, despite the near-term downside risks from the increase in fiscal restraint.

…

But underneath the fiscal drag the fundamentals in the private sector of the US economy are improving. The key force behind this improvement is the gradual normalization in the private-sector financial balance, i.e., the gap between the total income and total spending–or alternatively, the total saving and the total investment–of all US households and businesses, from levels that remain very high. When the private sector balance is high, the level of spending is low relative to the level of income. A normalization then means that spending rises relative to income, providing a boost to demand, output, and ultimately employment and income. The induced improvement in income then has positive second-round effects into spending.

…

Continued normalization in the private sector balance is the key reason why we expect growth to improve gradually in the second half of 2013 and into 2014. While fiscal policy will likely remain a drag on growth, the extent of that drag–measured as the change in the structural budget balance–is likely to diminish from what looks like a peak in early 2013. If so, the healing in the private sector is likely to produce a gradual pickup in US GDP growth.

There’s a reason why I’ve described Hatzius as the best analyst on Wall Street. He just gets it. He’s one of the only people on Wall Street who I’ve ever seen connecting all these different dots from differing views of the world.

Source: Goldman Sachs

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.