In a recent note at Goldman, Jan Hatzius cites a major trend from the last few years that’s likely to continue – labor market slack. Of course, this has a broad impact on many facets of the economy. In particular, corporations and consumer spending. It’s a strange sort of environment we’re in because consumers are just strong enough to keep spending at a modest level, but not strong enough to spend at a rate that causes very high inflation. And this puts corporations in the driver’s seat. They can maintain a steady revenue flow and manage their largest expenses (their employees) at a rate that isn’t overly onerous on margins. In other words, the capitalists are beating the labor class.

Anyhow, Hatzius cites these two major implications in the note saying that continued slack in the labor market will do two things:

- It will keep corporate margins high and possibly even rising.

- It will keep inflation low.

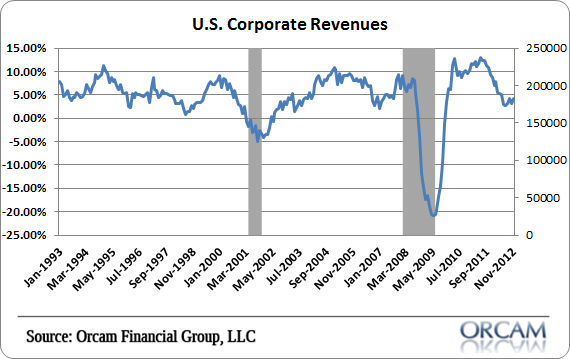

Of course, the margin expansion story is contingent on more than just the expense side. And that’s where things get a bit more dicey. Corporate revenues are slowing to the mid-single digits and perhaps even lower. See the chart below for the big picture there. That doesn’t mean margins have to decline, but it does mean the labor market is likely to remain weak. In other words, the capitalists win again.

Chart via Orcam Financial Group:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.