Michael Casey from the Wall Street Journal wrote a provocative piece last week that laid out the case for hyperinflation in Japan. The argument essentially comes down to too much government debt:

“The potential catalyst, Japan bears say, lies in the country’s suffocating debt levels. Gross government liabilities are currently worth more than 220% of GDP and projected by the International Monetary Fund to exceed 240% by year-end, an unprecedented level for advanced economies. If Mr. Abe’s aggressive measures ultimately fail, these people argue, Japan must reduce its debt if it is to avoid a massive reduction in living standards required to pay its bills.”

Okay. Japan has a lot of government debt. But that also means the private sector has a lot of savings (by accounting identity, the government’s debt is the non-government’s saving). I know people seem to have an aversion to government debt, but debt alone is not an ingredient for disaster. After all, our entire monetary system is credit based. One person’s liabilities are someone else’s assets. That’s just double entry bookkeeping. There’s two sides to the coin. So there has to be more to the story than just stating that debt:gdp levels are high because that’s like pointing out that private assets:gdp are high. Depending on your bias, you could make this sound however you want to make it sound.

Anyhow, there are 4 reasons why I think Japanese hyperinflation is highly unlikely:

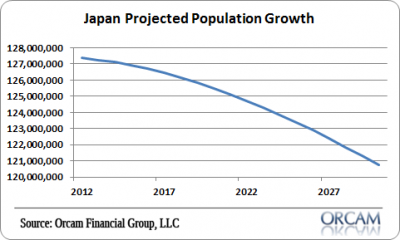

1) Japan is suffering from a massively deflationary population decline. Japan’s population is projected to decline -5% in the next 20 years. If we look at the most basic macro GDP equation including population growth (Growth Rate of GDP = Growth Rate of Population + Growth Rate of GDP per capita) then Japan has a huge deflationary headwind ahead of them.

2) In some cases an output decline can be disastrous. For instance, in Weimar the manufacturing collapse created an environment where aggregate supply collapsed and you had a classic case of too much money chasing too few goods. I think Japan is highly unlikely to experience a “collapse” in output, however. In fact, Japan’s highly productive workforce has kept the economy afloat over the last 20 years despite the greatest de-leveraging in modern economic times. If anything, when we consider that the de-leveraging has slowed, Japan’s economy looks better than it has in a long time. They still have the population decline to overcome (which is a hugely negative headwind), but I wouldn’t say it creates the risk of a collapse in output.

3) Japanese technological advancement continues to be highly deflationary. When it comes to advanced economies versus developing economies we have to be mindful of the rate of change in new technologies. Emerging economies are more susceptible to hyperinflation because the life cycle of their output is much longer than the life cycle of products in a developed economy. In a technologically advanced economy like the USA or Japan this can be hugely deflationary for vast segments of the economy. That is, consumers and producers are constantly upgrading their technologies with newer and more efficient means of production. This means productivity is rising rapidly. Often times too fast for wage growth to keep pace. That’s not inflationary. It’s more likely to be deflationary.

4) In my paper on understanding hyperinflation I noted that hyperinflation tends to occur around some very specific exogenous forces. That is, hyperinflation tends to be much more than a monetary phenomenon. It tends to occur when one of the following events unfolds:

- Collapse in production.

- Rampant government corruption.

- Loss of a war.

- Regime change or regime collapse.

- Ceding of monetary sovereignty generally via a pegged currency or foreign denominated debt.

None of these events are currently occurring in Japan. That doesn’t mean something else couldn’t cause the Japanese hyperinflation, but if you’re betting on hyperinflation one of these 5 events is almost certainly always involved.

Could hyperinflation happen in Japan? I guess. Maybe I’ve overlooked something more obvious. But I think the odds are fairly low.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.