Jeff Gundlach of DoubleLine Capital provided some detail on one of their new funds – the Multi-Asset Growth Fund (DMLIX) in a conference call today. The presentation gave some insights into how he approaches the portfolio construction. What differentiates Mr. Gundlach is his talent as a master allocator and risk manager.

In many ways, this fund appears similar to a lazy portfolio or an Ivy Portfolio – a broadly diversified fund that seeks to benefit from the potential growth and correlations (often inverse) of differing assets. It removes stock picking (which I love), focuses on protecting the downside (by maintaining healthy cash levels) and utilizes a unique expertise in risk management and fixed income to generate high risk adjusted returns. Mr. Gundlach elaborated on some of the bigger themes that drive growth:

- When he doesn’t like markets he prefers to just get out (into cash).

- The equity portion is not based on stock picking. He sees stock picking as a waste of time and prefers to focus on sectors, industries & indices.

- Capital preservation is just as important as portfolio growth.

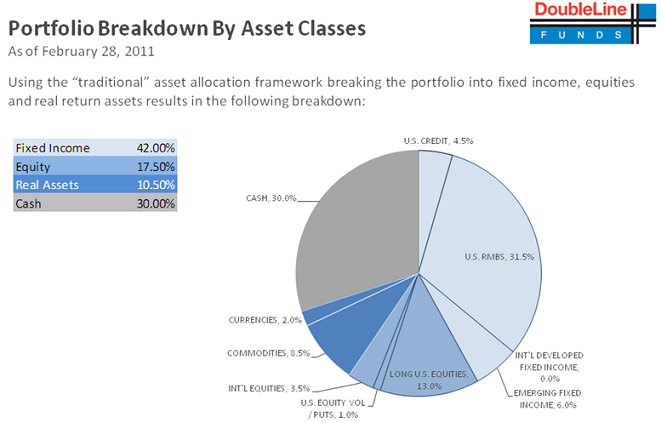

- You can see the composition below:

Update – DoubleLine contacted me to clarify that the cash position will not necessarily be maintained at 30% and will likely be deployed over time.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.