There have been a few very consistent good news stories over the last few years. And one of them is the story behind initial jobless claims. Claims, in case you don’t know, tracks how many people file for unemployment insurance every week. It’s virtually a real-time jobs data point since it’s released every single week.

The latest data at 323,000 showed the lowest claims data since Q4 2007. That brings our 4 week moving average to 336,750. That’s good news. It bodes well for the labor market and shows that the private sector is increasingly picking up the slack on the hiring front.

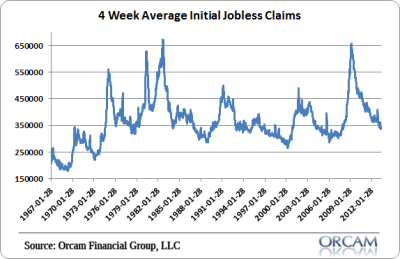

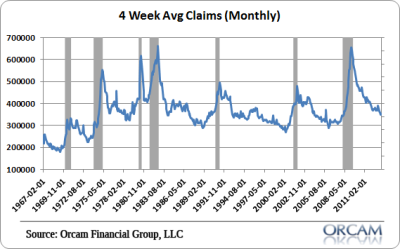

So it’s all good right? Well, kind of. I’ve been pretty vocal in recent years about the no recession risk in the USA. I think this latest claims data continues to confirm that view. But we also have to become increasingly mindful of history. One thing you’ll notice about claims is that the economy tends to top out when claims breach the 300,000 level.

In other words, as you can see in the chart below, the economy tends to start stagnating when claims reach that level. And that tends to be a precursor to economic slowdown. The good news is that we’re still not there. The bad news is that we’re a lot closer to the end of the cycle than we are to the beginning.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.