I missed this nice piece in the WSJ by John Cochrane. It’s a very balanced perspective of QE. I particularly liked this section which will sound very familiar to regulars:

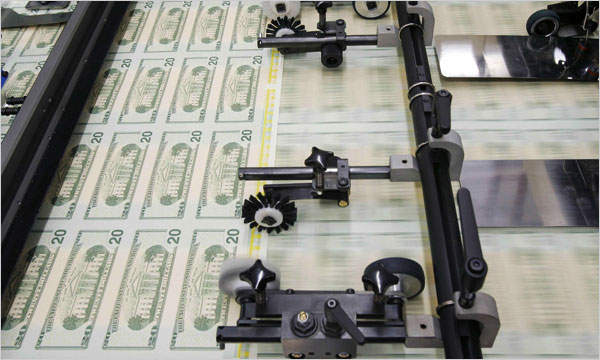

“This policy is new and controversial. However, many arguments against it are based on fallacies. People forget that when the Fed creates a dollar of reserves, it buys a dollar of Treasurys or government-guaranteed mortgage-backed securities. A bank gives the Fed a $1 Treasury, the Fed flips a switch and increases the bank’s reserve account by $1. From this simple fact, it follows that:

• Reserves that pay market interest are not inflationary. Period. Now that banks have trillions more reserves than they need to satisfy regulations or service their deposits, banks don’t care if they hold another dollar of interest-paying reserves or another dollar of Treasurys. They are perfect substitutes at the margin. Exchanging red M&Ms for green M&Ms does not help your diet. Commenters have seen the astonishing rise in reserves—from $50 billion in 2007 to $2.7 trillion today—and warned of hyperinflation to come. This is simply wrong as long as reserves pay market interest.

• Large reserves also aren’t deflationary. Reserves are not “soaking up money that could be lent.” The Fed is not “paying banks not to lend out the money” and therefore “starving the economy of investment.” Every dollar invested in reserves is a dollar that used to be invested in a Treasury bill. A large Fed balance sheet has no effect on funds available for investment.

• The Fed is not “subsidizing banks” by paying interest on reserves. The interest that the Fed will pay on reserves will come from the interest it receives on its Treasury securities. If the Fed sold its government securities to banks, those banks would be getting the same interest directly from the Treasury.”

I like that. Sounds like he’s adopted my “asset swap” view of QE. Swapping red M&Ms for green M&Ms doesn’t help your diet. That’s exactly how QE works. Swapping T-bonds for reserves doesn’t mean the private sector has more financial assets or spending power. And it certainly doesn’t mean that banks are willing to lend more. Cochrane seems to understand endogenous money and reserve accounting which is pretty unusual for most mainstream economists.

So, the narrative appears to be shifting more and more towards the sorts of things I’ve been saying for the last 5 years. Which means that we’ve basically wasted all this time focusing on potential transmission mechanisms for stimulus that were never going to happen. And that’s 5 years of sub-par growth because we put our faith excessively in a program that does a whole lot less than people originally thought.

Better late than never I guess.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Michael Basile

I guess the real question is, where would the 10 year be in the absence of QE and where “should” the fed funds be considering where we are as an economy. I don’t know but are emergency measures needed? If not, do rates reset putting pressure on the valuation of equities? Pretty simple to me. QE may help/hurt cause inflation or not. Fed policies have potentially distorted asset prices. That to me is the issue. Notice I said potentially because nothing is absolute:)

_UnknownMale_

Cullen,

I understand this but if it is just the asset swap and doesn’t affect the loans which banks would make or doesn’t increase any money in the private secotr, why does Fed do these QEs to begin with?

-AarBee

Cullen Roche

Well, there are other side effects. The primary one is the portfolio rebalancing effect. By changing the composition of outstanding financial assets the Fed creates demand for other financial assets. This could push down interest rates and boost other asset prices which makes people feel wealthier thereby spending more and investing more. Of course, that assumes that all else is equal, which it isn’t. But that’s one of the ways that QE could help….

Andrea

So, what is it that QE actually does?

Stu

I would love to hear feedback on this exact question of “where would the 10-year be in the absence of QE”. It is a question I’ve asked many times, but never received an answer of any substance. Cullen, I’ve been a devoted reader of yours for the past year or so and look forward to your thoughts. If you’ve written on it before, please let me know where to look.

John Daschbach

Cochrane has recently made another argument that I have made for some time that if the Fed does actually have an impact on the market through OMO’s then it needs a very large balance sheet to be able to raise yields to fight anticipated inflation by flooding the market with securities. It should be clear by now that what Greenspan called a conundrum (when a large increase in the FFR took place and the 10yr yield decreased) regarding the transmission mechanism of the very short interest rates the Fed can largely control to the long term yields that are much more important in our economic system is not a conundrum at all. As duration increases the influence of the Fed on market prices asymptotically approaches zero.

Cochrane knows all this because his background and most of his work are in econometrics not economics. He is a Professor of Finance the the U of Chicago Booth School of Business. His academic work that I have read is very much in the vein of financial econometrics. It may help to think of econometrics as engineering and economics as theoretical physics. His political pieces almost always are highly partisan and ideological and if you read without attribution as selection of his academic papers and his political writings you likely not think it the work of the same person.

Here is Cochrane in a 2011 article in National Affairs: “As a result of the federal government’s enormous debt and deficits, substantial inflation could break out in America in the next few years.” …”Think of Zimbabwe in 2008, Argentina in 1990, or Germany after the world wars.” ..”We stand at the brink of disaster. Today, we face the possibility of a debt crisis, with the consequent financial chaos and inflation, that the Fed cannot control.”

I wonder if he even wrote most of this article. It reads almost as any computer generated piece from the Peterson Institute, Club for Growth, … In fact, if you read the article critically, it’s impossible that the same person wrote these two pieces.

In the 2011 NA piece he made the following argument:

Based on his academic writings I think Cochrane is an intelligent person. But it’s not possible for an intelligent person to write the 2011 NA piece and the 2014 WSJ piece without at the outset stating that their views have changed substantially on core factors. Changing views is a core characteristic of intelligence. The more intelligent the person the more willing they are to publicly change view and make note of the change. Milton Friedman did this with regards to the monetary base while he was at the Hoover Institute at Stanford.

One of the greatest lectures I’ve ever attended was by Bruce Ames, of the Ames’s test that underlies our regulation of carcinogens. Based upon 25+ more years of research at UC Berkeley his views changed significantly and he no longer considered the Ames’s test to be a scientifically useful measure.

Why is this important? Because macro economics is even more backwards than carcinogen regulation. A real scientist like Ames is vocal about the failures of his past models and the increase in his (and hopefully collective) knowledge time has allowed. Economists and economic pundits are exemplary in their ability to disregard the basic tenets of Western Knowledge.

Cochrane is bright but he somewhat fails at the core values of Western Intellectual Thought.

Suvy

I actually did a post on QE too (two posts actually). It’d have been better if Cochrane goes through the balance sheets and went through the different kinds of monetary regimes. In 2008-09, the Fed went form targeting the short term money market rate of interest to targeting the monetary base.

Here’s the stuff I wrote on QE if anyone’s interested.

Monetary Policy Basics and QE

https://suvysthoughts.blogspot.com/2014/07/monetary-policy-basics-and-qe.html

The Impact of QE

https://suvysthoughts.blogspot.com/2014/08/impact-of-qe.html

Dave Holden

Does the Fed ever swap for things that aren’t government debt, I.e. private debt and if so is this “making good” that debt?

Andrea

I very much agree.

One of the main fallacies of these mainstream academics is that they have drank the kool aid of “equilibrium” economics. In fact, “econometrics” is nothing more than “economics on equilibrium models”.

None of these models include the effects of money and banking properly, so they area totally incapable of providing useful insight.

In the end, the interpretation of these models ends up been on very ideological lines (to your point).

Mr. Natural

Several former FOMC members (Warsh & Stein) have suggested that by pushing down long term rates on Treasuries and MBS, QE encourages investment in riskier assets than warranted by risk/return considerations, and therefore decreases financial stability. I believe this point has a lot of merit for QE, and also for the practice of keeping the Fed funds rate at zero for 5 years.

For some of Warsh’s and Stein’s thoughts/criticism of QE, most of which are not addressed in Mr. Roche’s post, see the following:

Warsh:

https://online.wsj.com/news/articles/SB10001424052702304655104579165781051413674

Stein:

https://www.federalreserve.gov/newsevents/speech/stein20121011a.htm

Tom Brown

“So, the narrative appears to be shifting more and more towards the sorts of things I’ve been saying for the last 5 years. ”

Well, except that you can now find Vincent Cate posts on Seeking Alpha… 😀

https://seekingalpha.com/article/2451485-how-we-know-high-inflation-is-coming

Cullen Roche

Oh Vincent. Gotta give him one thing – he doesn’t lack conviction.

John Daschbach

“When my information changes, I alter my conclusions. What do you do, sir?”

While the quote is now felt to be mis-attributed to Keynes it does represent the difference between a rational thinker and an irrational one.

Inflation remains the subject of countless PhD thesis as anyone who has looked at the data critically understands that the simple views about monetary base and inflation are useless. I think much of this confusion is based in the personal micro economic perception that money is a store of value when macro economically money is required to be only a medium of exchange.

The model of zero impact from QE is the financial professionals view which treats money purely as a medium of exchange. It’s risk weighted analysis of all future flows correctly discounted (inflation, taxes, …). So, for a person whose background is finance, like Cochrane, the near zero impact of QE makes complete sense. But for a person who views money as a real store of value (and somehow is unable to understand that a Tsy bill/bond is nearly as liquid as a bank deposit) gets worked up about the increase in money (and the corresponding decrease in Tsy) this approach is not possible.

One of the side effects of having people like Vincent Cate is that people who actually understand important aspects of finance and economics take advantage of them. Who knows what Vincent has put his savings into but one has to guess he has not made optimum decisions over the past few decades.

killben

“And it certainly doesn’t mean that banks are willing to lend more”

The banks may not use it to lend. But could they use it to speculate and increase asset prices?

pliu412

The real problem of velocity V defined in V = PQ/M using in Cate’s article is that it does not reflect the the operational meaning of money M chasing goods PQ in the production money flows for measuring the inflation.

Thus, when V is going down or up, the real economic condition could be either demand-pull inflation (too much money chasing too few goods) or deflation (too few money chasing too much goods).

tealeaves

I gotta to wonder if the Japanese Vincent-san has given up on high inflation story in Japan after their 20 plus years of QE?