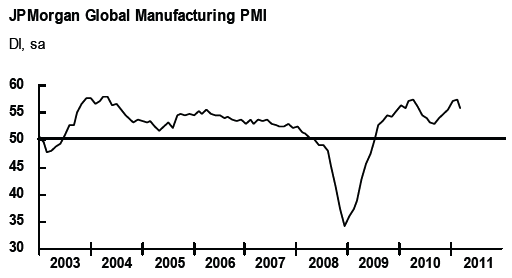

The JP Morgan Global Manufacturing PMI remains relatively robust for the month of March, however, did lose some traction. The index fell to a 3 month low at 55.8 in March. This is off from the 57.4 level recorded in February. Although the global expansion continues this is the lowest rate of acceleration in 3 months.

Some highlights from the report include slowing in China, strength in the USA, slowing in Europe, easing in new orders, stronger employment and rising input prices:

“The US manufacturing recovery continued to power ahead, with the rate of expansion the fastest in over seven years. China also saw a faster expansion, but not to an extent to fully recover the momentum lost following a marked slowdown in February. Although growth generally held up well in the other major industrial regions, rates of expansion were mostly slower than in recent months.

The Eurozone saw output rise at the slowest pace so far in the year-to-date and the UK at the least marked pace since last October. However, both saw growth remain well above their respective long-run survey averages. Rates of expansion stayed close to February highs in India and Russia. Meanwhile, the effects of the Tohoku earthquake meant that Japanese manufacturing output fell to the greatest extent since March 2009.

March saw growth of new orders also ease from the near-record highs signalled in the preceding two months. Rates of expansion moderated in the US, the Eurozone and China, while in the UK inflows of new business slowed sharply. Japan saw a marked decrease in incoming new orders.

Employment rose in almost all of the major industrial regions covered by the survey, the main exception being India. Rates of jobs growth were highest in the US and Germany, with the latter seeing employment rise at a survey record pace.

March saw a further marked increase in average input prices, with the rate of inflation remaining close to February’s two-anda-half year peak. Input prices indices were generally higher in the developed nations, especially the US where cost inflation hit a 32-month peak. The rate of increase in input prices in emerging

markets eased sharply, led by China and Taiwan.Commenting on the survey, David Hensley, Director of Global Economics Coordination at JPMorgan, said:

“Although easing from a near-record high in February, the March PMI data remained well above long-run trend and consistent with a robust increase in global IP of around 5-6% saar. This month’s global PMI was considerably stronger excluding Japan, where the natural disasters sent the Japan PMI and industrial

output plunging. There was little visible sign of supply-chain disruptions in the March surveys, but this effect is likely to be more visible in EM Asia in April.”

Source: JP Morgan

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.