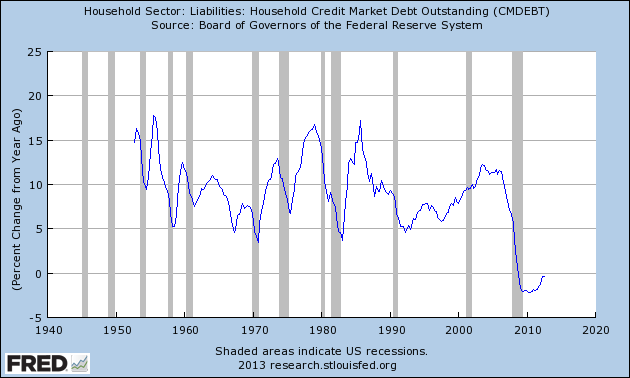

There’s been a lot of talk in recent months about the end of the de-leveraging cycle in the USA. Richard Koo, who coined the term “balance sheet recession” to describe the de-leveraging cycle, isn’t buying it. In his latest note he describes why the USA has years left to go. He says:

“If people who had been paying down debt to repair their balance sheets had actually resumed borrowing, it would mean that balance sheet problems were behind us. However, the fact that the latest colored bar in Figure 1 is above zero indicates that US households are still paying down debt.

Inasmuch as this act of reducing financial liabilities in spite of zero interest rates runs counter to the principle of maximizing profits, it suggests that US households continue to undertake balance sheet adjustments.”

See the accompanying chart via FT Alphaville for details here.

I think Koo’s view is confirmed by the NY Fed’s latest data on quarterly household debt trends. They showed another quarter of de-leveraging. But the balance sheet recession isn’t an event. It’s a process. And the process is very clearly moving in the right direction. For instance, see the improvement in consumer borrowing year over year:

We’re obviously digging out of a deep hole there, but we’re digging. Household debt is on the verge of turning positive. There’s still a lot of work to be done here and the recovery remains fragile, but we’re moving in the right direction. I’d previously estimated that the balance sheet recession could be over by 2013/2014. That could be a bit optimistic if you consider “the end” a return to historical trend debt accumulation of about 7%, but we’re moving in the right direction. Just one more reason why it’s so important for the government to remain supportive of very weak private sector trends here….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.