In a recent research note Liz Ann Sonders, Chief Investment Strategist at Charles Schwab, highlights the negative sentiment that is persisting in the economy. She cites a little known fact showing that negative consumer sentiment is actually very good for equities:

“Weak consumer confidence good for stocks … huh?

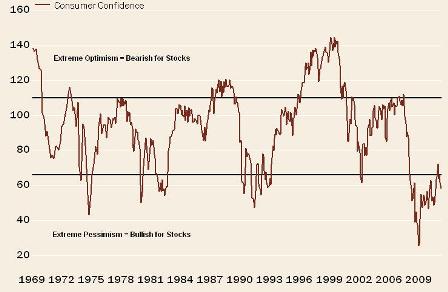

I want to transition back to the macro landscape now. Let’s take a look at what has been one of the stickiest of weak indicators—consumer confidence.As you can see in the chart below, the Conference Board’s measure of Consumer Confidence hit an all-time low in March of 2009. It has since risen, but the latest dip puts it back in extreme pessimism territory—a territory in which it’s resided less than 15% of the time.”

This is a contrarian thought, but the proof is in the pudding. When consumer confidence is over 110 equities have returned -0.2% per year. When consumer confidence is between 66 and 110 equities have returned 6.4% per year. And when consumer confidence is below 66 equities have averaged an annual return of 14.9%. Like my Wall of Worry, this gives some credence to the idea that stocks climb a wall of worry….

Source: Charles Schwab

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.