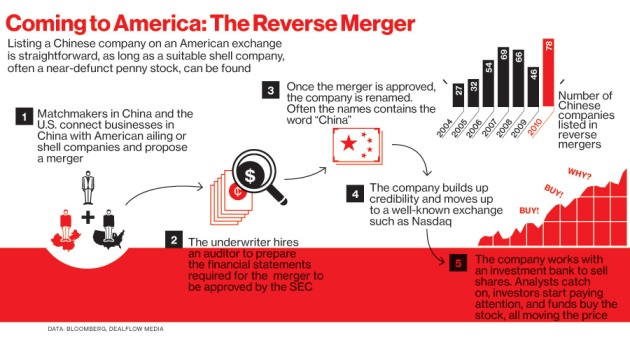

Bloomberg has been running a pretty interesting piece on Chinese companies that use what’s called a reverse merger to list in the USA and eventually raise capital. But what’s becoming an interesting trend with many of these companies is accounting irregularities. Several of them have already been exposed as outright frauds and many more are supposedly filing fraudulent SEC documents and are under investigation.

This is not the first instance of someone calling Chinese accounting into question. A recent wikileaks wire said the Chinese government’s GDP figures were fraudulent. Jim Chanos, who famously uncovered Enron, says China makes Enron look like a walk in the park. We already know China has been building entire cities and malls (see the world’s largest EMPTY mall here) just for the sake of building something to generate economic activity so there appears to be a trend of things looking too good to be true. And we all know that when something appears to good to be true it generally is.

The emergence of the reverse merger fraud in the USA raises the question of how prevalent these problems are in mainland China. I could just be jumping to conclusions here, but as the evidence begins to be revealed over the years you begin to wonder just how real the economic miracle in China really is….

You can find the entire Bloomberg story here.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.