Just a few brief thoughts on this morning’s manufacturing data which continues a streak of weaker than expected data in this space.

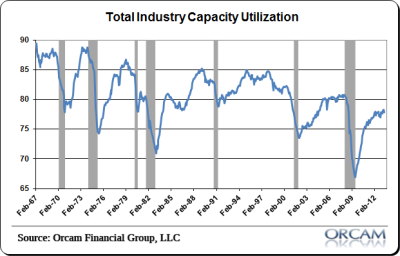

Total industry production was very weak at -0.5%. The manufacturing component registered a -0.4% decline. Analysts had been expecting a 0.1% rise. Durable goods were particularly weak at -0.6%. Total capacity utilization declined to 77.8 versus expectations of 78.3. In other words, this report was kind of a disaster.

As you can see in figure 1 the economy remains well below its potential. The current readings are still consistent with many past recessionary environments. So it’s not surprising that this environment still feels like a recession to many. That’s because, in relative terms, we’re in the midst of a very meager recovery.

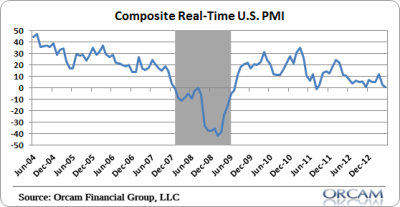

Figure 2 updates the composite real-time PMI index which declined from 2.5 to 1.1 as of this morning’s data. In addition to the industrial production data the NY Fed reported a weak manufacturing environment with the first negative reading there since January. The composite index is basically hugging the contraction line so manufacturing is a very weak segment of the economy.

A few key takeaways:

- This is all consistent with a low inflation environment.

- This is all consistent with a muddle through environment.

- This is not yet a recessionary environment.

- This is nothing to cheer about.

(Figure 1 – Total Capacity Utilization)

(Figure 2 – Composite Real-Time PMI)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.