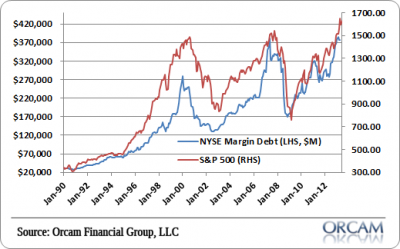

Is the top in for margin debt? Has the concern about higher rates potentially put an end to the massive borrowing that is helping to fuel the stock market surge? Who knows for certain, but the June NYSE margin debt data showed a slight decline from May.

The June debt levels of $376,632M was down from $377,002M in May and down from the May peak of $384,370M. This was the first multi-month decline since May of 2011 just before the market got spooked by the Euro crisis. As you can see below, the S&P 500 tends to correlate highly with margin debt.

Of course, there’s no way to be certain that this is anything more than a highly correlated data set and not necessarily a case of causation. Margin transactions do not require borrowing first and then placing a transaction so this could be nothing more than a sentiment indicator as opposed to a leading indicator.

Interesting nonetheless. Here’s a chart via Orcam Research:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.