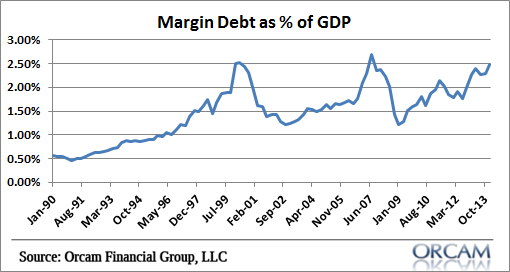

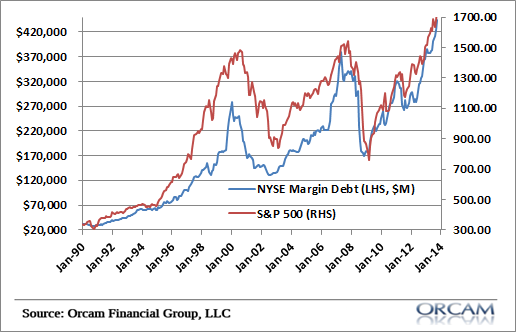

NYSE margin debt hit a new high of $444MM in December as sentiment over equities remained euphoric. Equally interesting, margin debt as a percentage of GDP hit a new high of 2.48% during this bull market. That’s still just shy of the previous highs, but getting very near all-time highs nonetheless.

Of course, it would be silly to assume that this indicator is going to tell you when the market’s turning and I know a number of people have raised valid concerns about this metric, but I still find it to be a useful indication of broader sentiment. That is, as equities rally and euphoria increases we tend to see increasing levels of debt accumulation. And yes, we know that much of this is long only debt because short interest has actually been declining at the NYSE over the past 5 years. This is all consistent with the idea of a disaggregation of credit and the tendency for herding behavior to lead to increased euphoria as market participants view the bull market as increasingly invulnerable. Classic debt dynamics in an equity market cycle. That kind of stuff.

Some pretty pictures follow:

Margin debt as % of GDP

Margin debt vs the S&P 500

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.