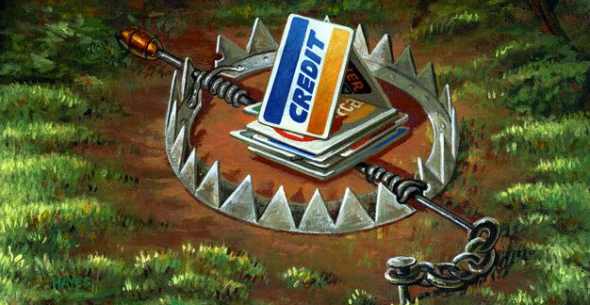

I’ve seen some “debunkings” of margin debt in recent weeks that remind me of the repeated claims in 2006 where most people thought the household debt bubble was totally benign. It’s funny how credit cycles work. When we’re at the bottom no one can get it and everyone thinks it’s bad and when the cycle ramps up everyone can get it and no one thinks it’s bad. Anyhow, understanding why credit matters is important. And the stock market is not unique in this regard.

The margin debt story is particularly interesting because I’ve had some personal experiences with it. I’ll never forget October 2008 when I was on the phone with an old friend of mine who worked on the institutional debt desk at Deutsche Bank. It was late in the evening NYC time and he was still in the office sorting through the shit show that had just transpired during the work day. I was in California and the sun was still shining. The world seemed fine. But my friend’s world was falling apart. He’d been dealing with clients all day who were being forced out of positions they didn’t actually want to sell because they were margined up. And this was putting huge downside pressure on prices. The week I talked to my friend the S&P fell something like 20%. IN A WEEK. Anyone who talked to the guys in the trenches that week knew margin debt mattered. It mattered a lot. If you didn’t have access to credit in October 2008 you were up Shit Creek without a paddle and a tidal wave was pouring down on top of you.

Irrational or not, this really happened. It wasn’t a myth. It wasn’t like the Hindenberg Omens, Death Cross or other non-sensical technical patterns that spell impending doom. This was a real fundamental driver of prices. And when you’re operating in a credit based monetary system access to credit is always a real fundamental driver of future output, prices and markets. Again, the stock market is not immune to this reality.

Margin debt really just represents the psychology behind the access to credit. It doesn’t necessarily spell impending doom. After all, over the long-term credit will always rise in a credit based monetary system. That’s to be expected. But we should also be wary of credit levels and how credit is being used in certain environments. When I see corporate profits dragging along at 4% year over year and margin debt hitting new highs mainly because people believe Ben Bernanke can keep the stock market propped up for the rest of eternity, my ears perk up. The risk manager in me starts to ask questions. It doesn’t mean margin debt will cause the stock market to crash. But it does mean that risk appetite is surging. And people are borrowing to buy shares they otherwise couldn’t afford.

Credit matters. And margin debt matters. It might not be a sign of impending doom, but it’s also not something we should just shrug off as if it’s some inane technical pattern or myth. This is a very real thing. And it cuts to the heart of our monetary system. I don’t know if it’s at unsustainable levels, but it’s a sign of the times. And this time, lots of people seem to be convinced that credit doesn’t matter. Until it does of course.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.