Traders bid up equities on the last day of February with the hope that the first of the month trend would continue today. Unfortunately for these speculators they woke up to a market with no bids. Ultimately, a benign ISM report, weak Chinese PMI and surging oil prices smashed these traders back down to earth as S&P 500 futures sank 1.5% on the day.

- As previously mentioned, Chinese PMI was weaker than expected. This is not to be overlooked by investors as the recovery in China has been the primary driver of the global recovery. A slow-down in China would almost certainly choke off recovery as the developed markets remain mired in balance sheet recessions.

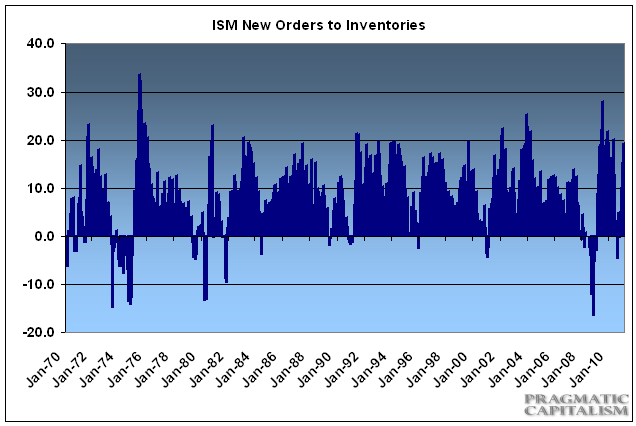

- The ISM was relatively strong at 61.4. The report was similar to the last few and showed strength almost across the board. Investors were not surprised by the report as broad economic strength has come to be expected. Employment and new orders both hit new highs while inventories sank. This is good news for future business and the current level of inventories:new orders is consistent with past levels of growth.

- Investors are not concerned with last month’s economic data as the story of the day is the continuing unrest in the middle east and its potential impact on future economic data. Brent crude surged over $115 as reports of unrest in Iran rattled markets and generated fears that these problems could be much larger than just Libya (via LA Times):

“The market had stabilized on Friday and Monday, helped by Saudia Arabia’s promises to make up for cutbacks in Libyan oil output. But the headlines from the Middle East on Tuesday were uniformly frightening for markets. Libyan strongman Moammar Kadafi showed no signs of capitulating to Western demands that he step down, protests raged in Yemen and new anti-government demonstrations were reported in Iran.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.