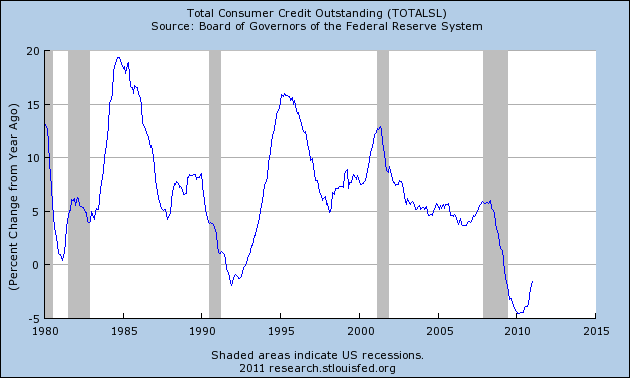

Despite lopsided balance sheets and near record levels of household debt the Fed appears to have succeeded in convincing American households that it is wise to begin re-leveraging. The Fed’s latest consumer credit report showed broad improvement in consumer credit trends (via Econoday):

“Revolving credit failed to post a second month of improvement, contracting $4.2 billion in January following December’s $2.0 billion gain. Non-revolving credit, boosted by strong vehicle sales, surged $9.3 billion in January following December’s $2.1 billion gain. December remains the only month that both revolving and non-revolving credit have expanded this recovery.

On a total basis, consumer credit rose a rounded $5.0 billion in January vs December’s $4.1 billion (revised down from $6.1 billion). Annually, total consumer credit is up 2.5 percent with non-revolving credit up 6.9 percent and revolving down 6.4 percent, again the latter a disappointment following December’s annual percent gain of 3.0 percent.”

As I’ve previously mentioned, this is great news for the near-term economic outlook. A re-leveraging consumer means more spending, higher corporate revenues, etc. My hope was that a 10% deficit would result in consumers continuing to de-leverage, however, that looks like wishful thinking. Instead, the combination of easy money and no loser capitalism appears to be setting the foundation for another debt binge. At a level of 115% of debt:income this trend is clearly unsustainable, however, the American public appears intent on sustaining its fiscal imprudence. In short, enjoy the growth, however, once the deficit shrinks or another asset bubble pops the air is going to come out of the debt bubble once again and the upside down US consumer will again be exposed as the imprudent consumer that he/she is….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.