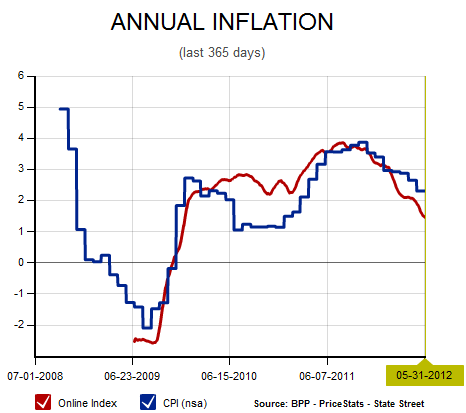

It’s abundantly clear by now that the many hyperinflation and even high inflation theories following the various government policies after the financial crisis, have been entirely wrong. While this has become very clear in recent CPI readings it’s also apparent in many independent gauges. For instance, the Billion Prices Project is now showing inflation crashing down to just 1.5%. This has been a superb indicator of inflation and if it holds true to trend the CPI isn’t turning up any time soon. See Figure 1 below.

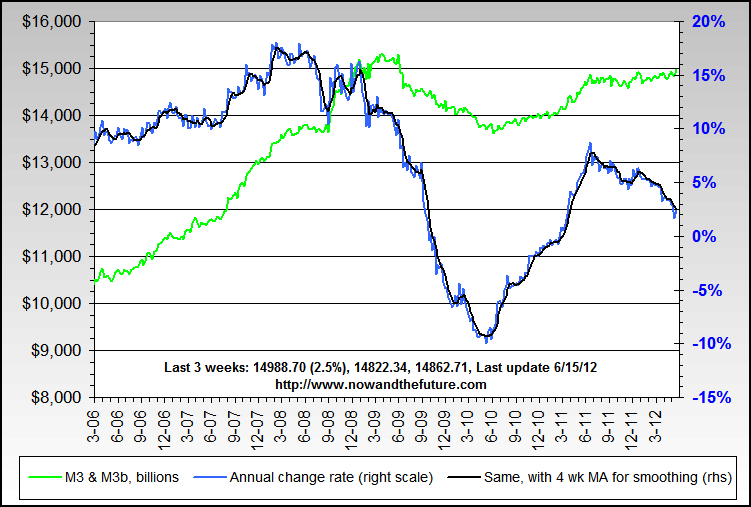

Equally interesting is the broader money supply indices. While the government stopped tracking M3 long ago, some independent sites still track it. What does it show? The same trend in the broader inflation indices. M3 is plunging lower in both of the widely followed independent M3 indices. This is all worryingly reminiscent of Japan….

(Figure 1 – Billion Prices Project)

(Figure 2 -Via Nowandfutures.com)

(Figure 3 -via Shadow Stats)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.