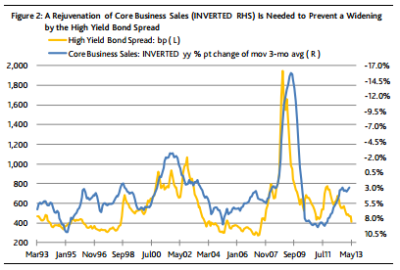

Here’s some interesting commentary on the state of the high yield bond market (which, as FT Alphaville says, might not be appropriately named given its actual low yields). Moody’s shows the divergence between corporate revenues and spreads:

“Our preferred measure of core business sales ―which equals the sales of retailers, manufacturers and wholesalers less sales of identifiable energy products ―rose by merely 3.0% yearly in Q1-2013, which was down from Q4-2012’s 3.5% and Q1-2012’s 6.2%.

The yearly increase previously ebbed to 3.0% in Q2-2008, Q4-2000, and Q3-1998, where each earlier deceleration was associated with a high yield bond spread significantly above its latest 410 bp. Thus, if expenditures do not quicken, what is now the narrowest high yield bond spread since October 16, 2007 could widen substantially. (Figure 2.)

The lackluster state of the world economy has curbed the growth of business sales. The US high yield bond spread has shown a strong inverse correlation with the JPMorgan/Markit global composite PMI index of world economic activity. Ordinarily, the high yield bond spread widens as the global composite PMI falls.

Nevertheless, despite how April 2013’s global composite PMI of 51.9 is well under its long-term median of 54.6, May 7’s high yield bond spread of 411 bp was well under its comparably measured median of 583 bp. Moreover, the statistical record suggests that the high yield spread ought to be closer to 700 bp, as opposed to approaching 400 bp. In fact, when the high yield spread last narrowed to 411 bp in December 2003, the global composite PMI approximated 60.0.”

Their conclusion – high yield bonds might actually be susceptible to reflecting the name that they less commonly referred to as – junk bonds:

“Until the global composite PMI posts significantly stronger readings, the high yield bond spread is vulnerable to a pronounced re-widening.”

Source: Moodys Research

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.