Over the last 3 years I have continually compared the situation in the USA to that of Japan’s. That was based on the idea that the USA was undergoing a balance sheet recession or a post bubble debt de-leveraging in which the private sector would remain too weak to sustain sufficient economic growth to close the output gap and generate full employment. This would require fiscal stimulus as the government sector becomes the only sector strong enough to offset the growth collapse.

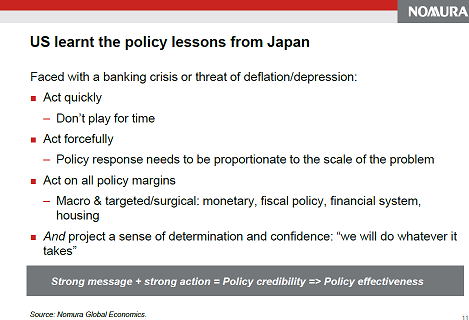

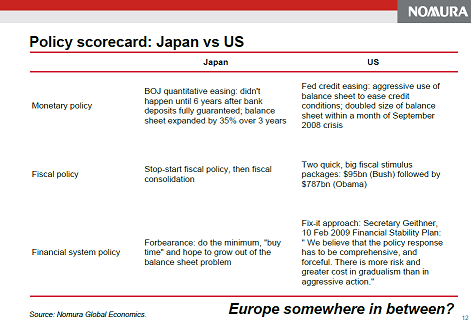

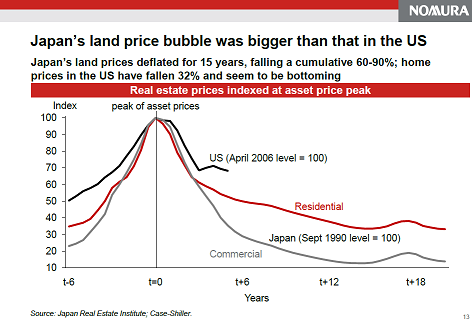

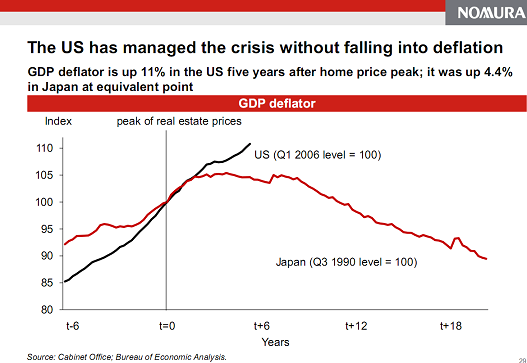

But I’ve made a very important distinction between Japan’s balance sheet recession and that of the USA’s. We are Japan on fast forward. This is based on several factors including our government’s faster response to the crisis, a less severe real estate bubble, spread out equity and real estate bubbles, consumer vs corporate balance sheet recession and the continual stimulus via large budget deficits (as opposed to the start and stop measures in Japan).

I was pleasantly surprised the other day when a fantastic presentation by Nomura’s Chief Economist Paul Sheard came across my desk. It meshes with my general views almost perfectly so I am obviously biased, but it sounds as though he’s been reading quite a bit of his colleague Richard Koo’s work, but ultimately agreed with me on the conclusion that we are not exactly like Japan and have in fact learned from their mistakes. He also makes several other conclusions that mesh with my view including myths about QE’s effectiveness, the Euro area being a currency crisis and not a debt crisis (and requiring fiscal union), QE’s transmission mechanism (or lack thereof) and a few others. As for the “we are Japan on fast forward” them he had 4 slides that sum up his position nicely:

Figure 1

Figure 2

Figure 3

Figure 4

As for the balance sheet recession, I am still seeing a 2013/2014 end date so no big changes there….But hey, in this sea of negativity, the bright side is that things could be a lot worse. We are not Japan…entirely. At least not for as long.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.