I wanted to expand on a point that some people have discussed in the comments. There are some who think that rising stock prices validate any move the Fed makes. And these same people seem to think that as long as stock prices are moving higher then that means that the Fed is being effective. Let’s think about this logically though.

First of all, stock prices are what people are willing to pay today for the future expected profits of the underlying corporations. There’s a real, although imprecise and at times irrational, connection between the stock price on a secondary market and the actual performance of the underlying corporation.

Of course, the stock is NOT the underlying company or the underlying economy. If it was then steering the economy would be easy. You could just have the Fed come in an jam stock prices higher and higher and we could all ride off into the sunset without having to produce anything or even requiring the underlying corporations to deliver any profits. But that’s not how the real world works. In the real world, the companies have to deliver the profits or the price of their shares falls to reflect the fact that no one is willing to hold those assets at prices that don’t reflect underlying fundamentals.

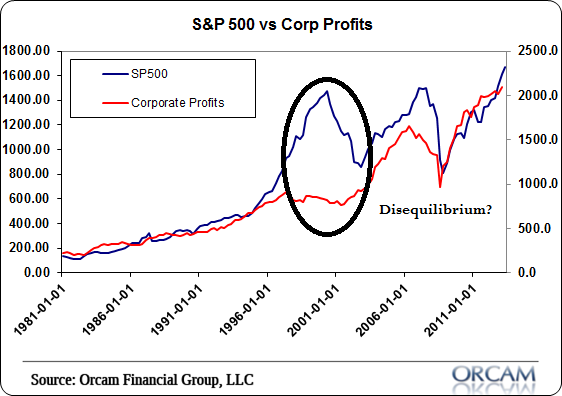

One reason why I express some hesitancy towards stock market focused policies like QE is because I think the stock market is particularly ripe for irrational behavior that can translate to economic disequilibrium. When you entice people to own stocks they tend to become more and more confident and increasingly willing to engage in classic herding behavior. This leads to surges in things like valuations, margin debt, etc. Which is all fine and dandy for a while. But when it gets stretched and then reverses course you tend to get a snowball effect and a market decline turns into forced defaults which turns into panic selling which causes the economy to seize up more than it would have without the market bubble. Volatility creates volatility. I think the period between 1995 and 2000 is a fine example of a period where the “Greenspan Put” contributed to highly irrational market thinking and a huge market collapse that hurt the economy more than it should have. The housing bubble had similar characteristics though arguably not as obvious as the Nasdaq Bubble.

The point is, we shouldn’t put the cart before the horse or read too much into rising stock prices on any given day. And more importantly, I think we should be careful about how we go about looking at stock prices relative to the real economy. Not only are they not the same thing, but a developing disequilibrium between the two can be a very dangerous thing. Now, I don’t think we’re in a 1999 environment or that the Fed has created a severe disequilibrium between profits and market prices, but I do think it’s worth considering the potential side effects of policies that focus on markets that have a tendency to be highly irrational at times. Especially when there are so many other policy options on the table that, in my opinion, have much lower risks associated with them.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.