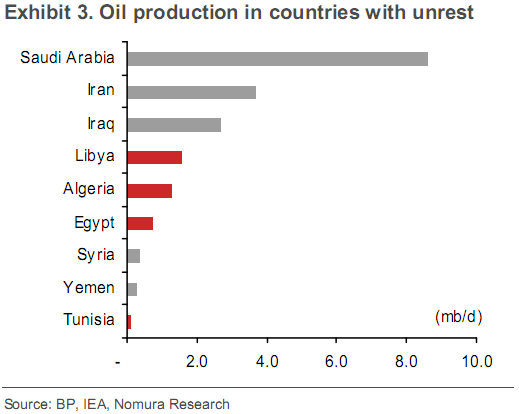

Nomura has a very good piece on the current situation in the Middle East and the risk of oil rising to $200. While Libya is a big player in the region the ultimate scare would come from any disruption in Saudi output. As you can see they are by far the largest player in the region:

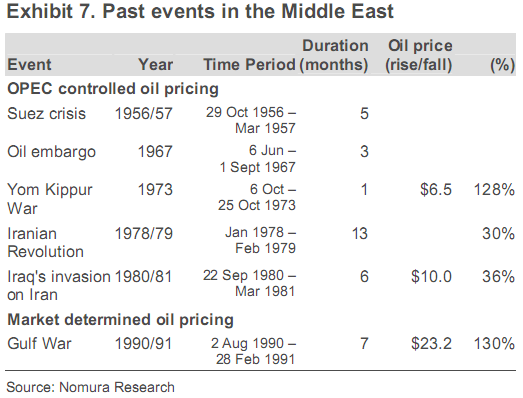

Nomura reviewed past oil disruptions in an attempt to gauge the potential outcome here:

In order to estimate the possible impact MENA crisis has on oil supply and prices, we analyse the past crises that have rocked the region. There have been a few events that drove oil prices higher, most of which are during the period in which OPEC controlled oil prices. For example, during the 1973 Arab-Israel war, OPEC increased oil prices by US$6.5/bbl or 128%, while in 1979-1981 the Iran revolution followed by

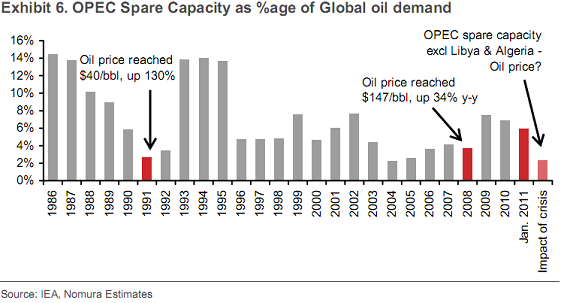

the Iran-Iraq war saw oil prices move up by about 77%. In fact the only major event that is comparable is the Gulf War in 1990-91 as it is the only event in the Middle East which seems close to the ongoing crisis during the free-market pricing era. Before the Gulf War, OPEC spare capacity stood at 5.9mmbbl/d. During the war, OPEC production capacity was severely reduced (OPEC spare capacity came down to less than 2.0mmbbl/d) and oil prices jumped 130% in a period of two and a half months.We can identify three distinct stages of the Gulf war which led to changes in oil prices. The initial phase is the anticipation of war and just the threat to oil supply; during this period, oil prices moved up by 21%. This is comparable to what we have seen recently – oil price is up by 13% since the beginning of the MENA unrest and we believe we are still at the initial stage of the three stage process for the current MENA unrest. As we see further evidence of real supply disruption, we will be moving into stage 2 of the event. The second stage is the actual reduction in oil supply when the Gulf war started and during this period oil price moved to its peak of US$41/bbl, up 109% within a period of two months. The third stage will mark the end of the crisis with the anticipation that supply will resume and during the Gulf war, prices returned back to pre-crisis level (below US$20/bbl) in three months.

One of the concerns today is that spare capacity is fairly high. That means OPEC is unlikely to add supply to the market despite the disruptions. This was confirmed by CNBC today who says that OPEC has no intentions of raising supplies:

Current OPEC spare capacity sufficient to ward off immediate supply concerns: Currently, OPEC spare capacity stands at 5.2mmbbl/d with 3.5mmbbl/d of that coming from Saudi Arabia. As a result, we believe that there is enough spare capacity available in the OPEC to ward off any near-term supply disruptions owing to the crisis as it stands currently. However, we could see a spike in oil prices in case supply is actually disrupted, given the uncertainty that it would bring.

If Libya and Algeria go offline, one can see a 3.1mmbbl/d of reduction in production capacity pushing spare capacity again to 2.1mmbbl/d, as seen in 1990-91. Even in 2008, when oil prices reached US$147/bbl, OPEC spare capacity was as low as 2.3mmbbl/d in June 2008, causing prices to spike a month later. Based on the Gulf War, coupled with the fact that demand is much higher now, leaving a lower spare capacity as % of demand, we estimate oil could fetch well above US$220/bbl, should Libya and Algeria stop production. We could be underestimating this as speculative activities were largely not present in 1990-91.

Past events show one disturbing similarity – they tend to persist for several months. If so, we are almost certainly closer to the beginning of these events than the end:

Nomura concludes that $200 oil is a very real concern in the near-term:

If the situation in the region were to worsen in a way that it encompasses other oil producing countries as well in the future, the oil supply-demand balance could change very rapidly. In particular, if the crisis were to spread to Saudi Arabia, (possibility of which is quite low at present according to our Senior Political Analyst Alastair Newton), there can be real threat to global oil production, the impact of which is impossible to ascertain on prices. In addition, the recovery in Middle East oil production would depend upon the extent of damage to oil infrastructure during the crisis and the extent of restoration of stability. Overall, we do not rule out the possibility of oil prices touching record highs in excess of US$200/bbl in the near term, should the MENA crisis continue to spread over the coming weeks.

ZeroHedge has the full piece.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.