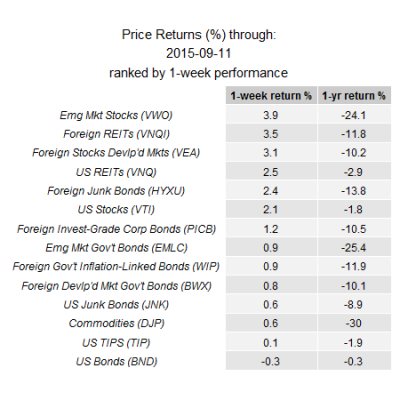

How weird has 2015 been so far? This weird – every major asset class is negative on a one year basis (via Capital Spectator):

I don’t have the exact data, but I would venture to guess that this just about never happens. Heck, even a long-term bond is barely positive on a 1 year basis. If you had told me that China might be falling apart in 2015, emerging markets were falling 25%+ and we’d have a flash crash I’d have guessed that long-term bonds were up 10%+ in that period. But no, even bonds have been suppressed.

I don’t have the exact data, but I would venture to guess that this just about never happens. Heck, even a long-term bond is barely positive on a 1 year basis. If you had told me that China might be falling apart in 2015, emerging markets were falling 25%+ and we’d have a flash crash I’d have guessed that long-term bonds were up 10%+ in that period. But no, even bonds have been suppressed.

There has been almost nowhere to hid this year. Except for cash of course. And I am old enough to remember a few months ago when certain Robo Advisor proponents were arguing that cash should never be held in a brokerage account. Aside from being a fallacy of composition that position looks pretty silly right now. But as they say, this too shall pass….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.