Disaggregation of credit is the understanding that there are good forms of credit and bad forms of credit. A good form of credit is something like a standard business loan in which a company obtains access to a line of credit in order to make investments in the firm. It pays employees, invests in equipment, etc. This form of credit, when issued prudently, is usually productive in that it helps the company expand and it rewards the lender for having taken the risk.

As a credit based money system we rely largely on the health of these sorts of loans to keep the system running smoothly. But there are also bad forms of credit. For instance, when a homeowner decides they want to speculate on real estate as an investment because they (incorrectly) believe real estate can outpace inflation over the long-term. We could make this matter even worse by repackaging the original loan and selling it off to new investors as AAA rated securities. In other words, disaggregation of credit was a core piece of the 2008 crisis.

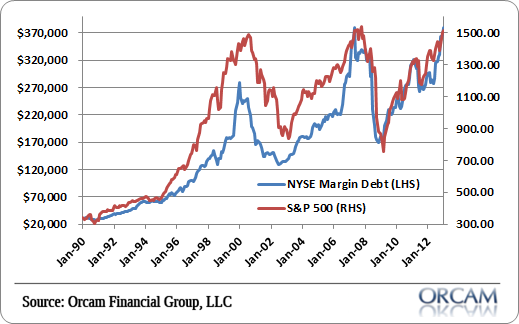

I think another sign of disaggregation of credit is the extraordinary growth in borrowing that occurs around stock market booms. As the market surges we inevitably see a sort of ponzi effect in the market where more confidence breeds more credit and the bidding up of prices. It works until it doesn’t and when it doesn’t the air sure comes out fast.

So it’s rather alarming to see NYSE margin debt just shy of its all-time high as of the March reading. My guess is we’ve actually already surpassed the all-time high though we won’t officially know until April data is released. Fun times knowing we live in a world that is built on such a fragile foundation.

Chart via Orcam Financial Group:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.