One of the few clear correlations between QE2 and anything else was the surge in margin debt. The Bernanke Put is the equivalent of telling traders that they have the green light to just go crazy within their margin accounts. Of course, 20 years of economic folly hasn’t been enough to convince the Central Bank that promoting this sort of policy is sheer madness so we continue to implement policy like QE2 with the hope that it will generate a “wealth effect” or some other mythical growth even though it does nothing to alter the net financial assets in the private sector.

In case you’ve been asleep for the last year it’s undeniable that the economy has weakened further with each consecutive quarter that QE2 went on. In other words, this program has been one of the greatest failures in the annals of central banking history. Even its long-time cheerleaders have now turned against it. Still, we hear chatter of QE3 as if we need to throw more you know what against the wall with the hope that it will stick…..

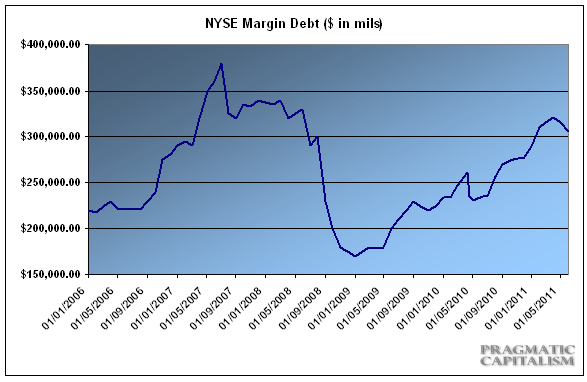

QE2 had one undeniable effect though. It caused investors to go crazy with misconception. And much of this was implemented with borrowed dollars. NYSE margin debt soared throughout the program and declined by $10MM for the first time in June in anticipation of the program’s end. That loud sucking sound you heard in the market today was the margin calls that these traders are now receiving.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.