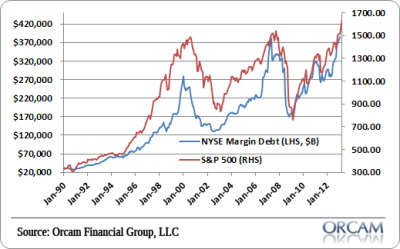

The latest reading on April margin debt at the NYSE showed an all-time high. The most recent reading of $384,370MM topped the all-time high from July 2007 when margin debt reached $381,370MM.

As I’ve explained in the past, this is one sign of how the disaggregation of credit has come to dominate many borrowing trends in the last 30 years. Instead of seeing credit used for productive purposes it has increasingly been used for things such as speculation in asset prices. My guess is that this is largely the result of a Fed driven economy whose policies have been uniquely asset price focused leading many to speculate due to excessive faith in the “Bernanke Put” or the “Greenspan Put”.

This trend is particularly interesting during the most recent recession since household credit has remained extremely tight. And while lending standards have relaxed in the last 18 months the banks clearly have no qualms about extending credit for less productive purposes like buying stocks on margin.

Chart via Orcam Financial Group:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.