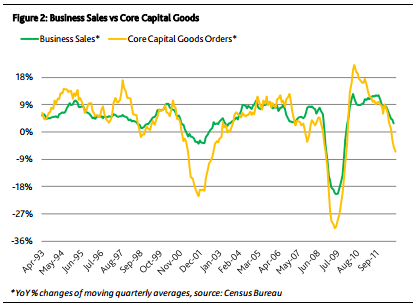

Here’s some rather disconcerting analysis from Moody’s on the state of corporate America. They highlight capital goods orders and correlation with business sales noting that such declines have only occurred in the mist of recession:

“Gains in the September durable goods orders report were not enough to accelerate US business sales. Core capital goods orders tightly correlate with sales and investment, and those orders fell 6.5% yearly last quarter — the sharpest decline in almost three years. Such a shortfall has been previously seen only in the throes of a recession. Domestic consumer spending growth may protect the economy from the full brunt of this distressing development, but businesses with international operations will not be as fortunate. When core capital goods orders have shrunk on a yearly basis, business sales growth fell by an average of 3.3% (Figure 2). Core capital goods orders held flat on a monthly basis in September; we must soon see them rise — like last month’s new orders subindex from the ISM Manufacturing survey — if we are not to see a deepening business sector slump.”

Source: Moodys

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.