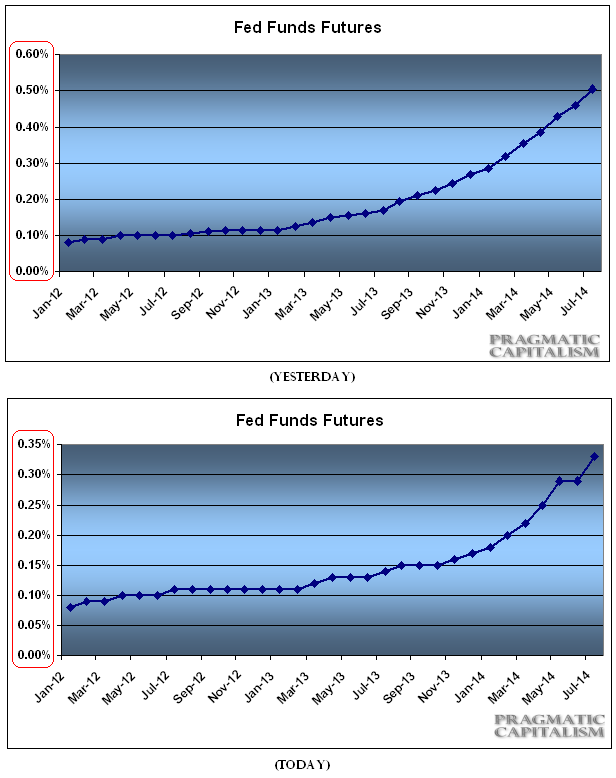

If you’re trying to visualize today’s move from the Fed then look no further than the Fed Funds Futures curve. Just 24 hours ago the curve was a full 25 bps higher than today. This move was the equivalent of a rate cut. Unfortunately, rate cuts stopped working about 2 years ago….

Nonetheless, the change in the curve shows just how much expectations have changed in 24 hours. The Fed has essentially pancaked the yield curve:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.