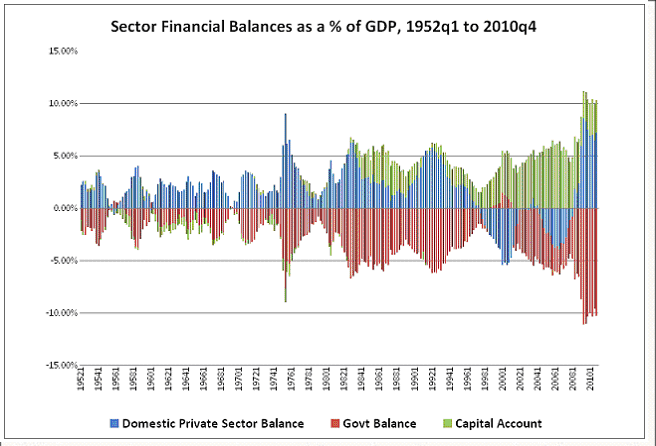

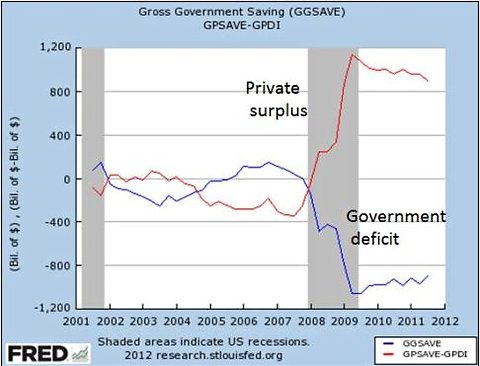

One of the more illuminating facets of Wynne Godley’s work is the sectoral balances approach. He showed us that the government’s deficit is the non-government’s savings. MR can be thoroughly confusing when first confronted, but the ability to digest this simple accounting identity is eye opening for many who first confront these ideas.* Godley’s work on the balances is largely ignored in mainstream economics though we do see it in some circles (Martin Wolf at the FT often highlights it). So it was nice to see Paul Krugman doing a bit of balances work the other day when he highlighted that the government’s deficit allowed the private sector to save more during the de-leveraging cycle:

Then I point to the huge swing of the private sector into financial surplus, which necessitated large public deficits to avoid a much deeper slump:

Just a few months ago Dr. Krugman highlighted the importance of being a currency issuer versus a currency user. Then he acknowledged that debt is (mostly) owed to ourselves and so creates a vastly different burden for an autonomous currency issuer than it does for a currency user. Now he’s dabbling in the sectoral balances. I think Dr. Krugman agrees with Modern Monetary Realism far more than he is likely to admit….

* see here for the identity:

GDP = C + I + G + (X – M)

C = consumption

I = investment

G = government spending

X = exports

M = imports

Or stated differently;

GDP = C + S + T

C = consumption

S = savings

T = taxes

From there we can conclude:

C + S + T = GDP = C+ I + G + (X – M)

If rearranged we can see that these sectors must net to zero:

(I – S) + (G – T) + (X – M) = 0

(I – S) = private sector balance

(G – T) = public sector balance

(X – M) = foreign sector balance

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.