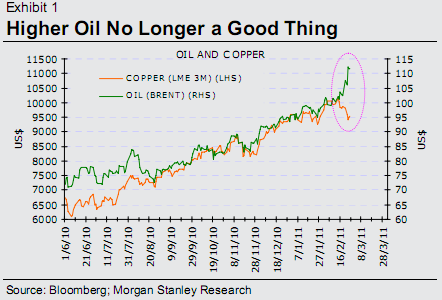

I first wrote about this a few weeks ago and since it’s a good barometer of real-time growth concerns it is useful to update periodically. The copper/oil divergence is a clear sign that markets are now worried about the negative impact of oil prices on global growth. Morgan Stanley elaborates with an excellent chart of brent and copper and explains (below) why spiking oil prices can cause declines in economic growth (via Hedge Analyst):

“Investors are now worrying that rising oil prices are less a symptom of macro strength and more a threat to growth. This shift saw the close correlation between the price of oil and the price of copper – another real-time growth barometer – break down (Exhibit 1).”

“It also matters how fast oil prices rise. Oil price increases – like any price increase – transfer spending

power from consumers to producers. This can have a distributive effect, but shouldn’t affect total income. If prices are rising slowly, stronger demand from producers can offset the adverse impact on consumer demand. If prices rise sharply, however, the adverse income shock – which is immediate – may not be offset by a commensurate increase in producers’ spending. That is why sharp increases in oil prices can do more damage to growth than an equivalent increase over an extended period.”

Source: Morgan Stanley

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.