One of the most important facets of a top down macro perspective of the world is the understanding of big picture trends. If you’re able to predict the general trend of the economy and the markets then it’s likely that you’ll look smart implementing any investment strategy that positively correlates to that view. I’m going to do a bit of data mining here, but I think the last 12 months are a good example of this.

12 months ago there were numerous calls for recession in the USA (I very vocally took the other side of these trades). As I described the other day in “Why Recession Forecasting Matters”, the most destructive market environments tend to occur during economic contraction. So being ill-prepared for potential contraction can leave your investment portfolio extremely vulnerable to severe losses.

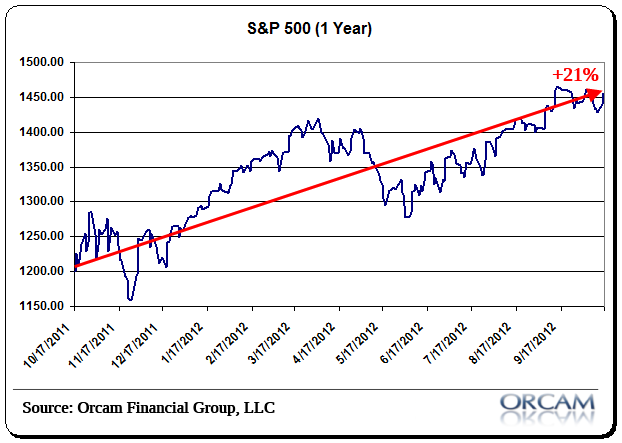

This cuts both ways though. Had you been excessively pessimistic about the economy a year ago you likely positioned yourself far too defensively. The result, as the figure below shows, is missing substantial market gains.

None of this is to imply that forecasting is easy, but understanding the big picture is absolutely crucial to any investment approach. Particularly in the current environment where globalization makes the world an increasingly tiny place. It’s a macro world and we’re just living in it. So knowing which way the tide is flowing has never been more important. And when you know the direction of the tide anyone can look like a great swimmer….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.