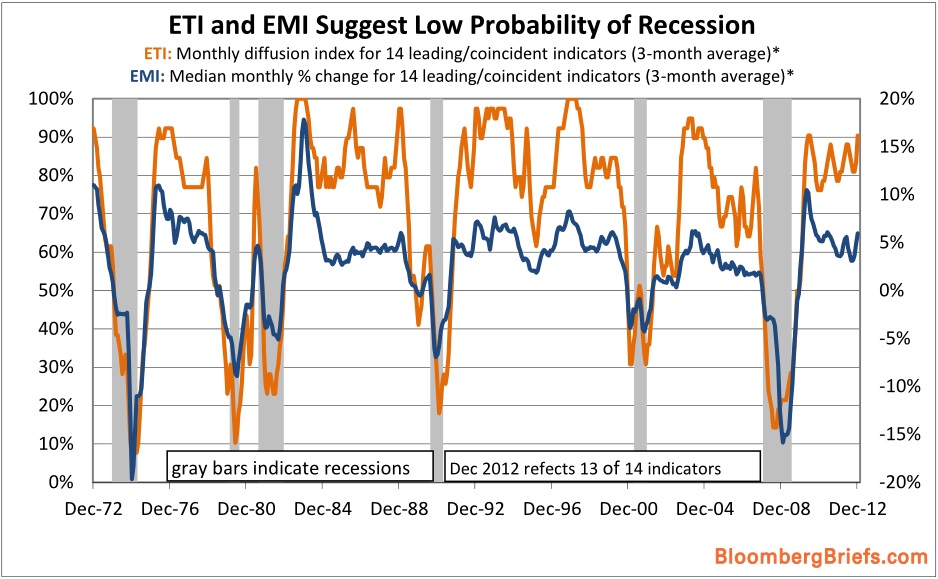

It’s not just the Orcam Recession Index that is pointing to low odds of a recession (and has been for years). Barry Ritholtz posted this from Bloomberg Briefs last week regarding some other independent recession indicators which are both pointing to low odds of recession:

A set of broad economic indices with a good track record say we are not in imminent danger of lapsing into a recession:

“Two economic indexes with impressive records of tracking the business cycle’s major downturns since the early 1970s indicate recession risk is low, based on a broad reading of economic data through December. While January’s profile has yet to be fully determined, the early numbers so far look encouraging.

The economic Trend index (eTi) remains well above the critical 50 percent mark, having risen above 90 percent at 2012’s close. The economic Momentum index (eMi) settled at 6 percent in December, a comfortable margin above the danger zone of zero and below.”

Chart via Bloomberg Briefs:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.