Rob Arnott of Research Affiliates is out with an excellent piece (as always) that follows up on the research about long-term volatility and investment returns. Arnott does a superb job of summarizing the myth of high equity investment returns. He notes the inconsistency in equity market returns and the unrealistic expectations that have often been used as a sales pitch to Main Street. Based on a long-term view of history, stocks have actually proven to be a much worse relative investment than Wall Street wants you to believe.

While most investors are programmed to believe that equities return 10% per year the truth is that equities have returned just 7.9% per year since 1802. That might not sound like a big difference, but when compared to bond market returns the risk adjusted returns look far more meager than you might have previously assumed. Over that same period bonds returned 5.1% per year. For investors these days this lack of risk premium hits home. The US equity risk premium over the previous 10 years is -5.3%, 0.7% over 20 years and just 0.53% over 30 years! In short, equities haven’t been the great relative value that the Wall Street pitchmen want you to believe.

Of course, the past 30 years have been unusual due to the nature of declining bond yields, but the moral of the story is important. Most investors are fed a sales pitch about this very long time horizon and “stocks for the long-run”. The truth is, most investors don’t invest for the long-run that is sold to them. Most investors have a shorter investment lifespan than Wall Street wants you to think and this time period isn’t always sufficient to satisfy the added risk in equities. As Arnott says:

“Shouldn’t a span of one, two, or three decades be sufficient for investors to be rewarded for bearing the risk of holding stocks? As displayed in Table 1, trailing returns for stocks haven’t come close to earning the excess returns that we’ve all come to expect, even after stocks worldwide doubled from the early March 2009 lows during the Global Financial Crisis! We’ll save an exploration for how the Fundamental Index® concept radically reshapes this picture for another time.

….

Where is the wealth creation implied by the Ibbotson data? Stock market investors took the risk—riding out every bubble, every crash, every spectacular bankruptcy and bear market, over a 30-year stretch.

How much were they compensated for the blood, sweat, and tears spilled with all this volatility? A measly 53 basis points per annum! Indeed, investors who have incurred the ups and downs over the past

decade have lost money compared to what they could have earned from long-term government bonds.

They’ve paid for the privilege of incurring stomach churning risk. Not only did Treasury bond investors

sleep better, they ate better too!A 30-year stock market excess return of approximately zero is a huge disappointment to the legions of “stocks at any price” long-term investors. But it’s not the first extended drought. From 1803

to 1857,5 U.S. equities struggled; the stock investor would have received a third of the ending wealth

of the bond investor. Stocks managed to break even only in 1871. Most observers would be shocked to

learn there was ever a 68-year stretch of stock market underperformance. After a 72-year bull market from 1857 through 1929, another dry spell ensued. From 1929 through 1949, stocks failed to match bonds, the only long-term shortfall in the Ibbotson time sample. Perhaps it was the extraordinary period of history—The Great Depression and World War II—and the spectacular aftermath from 1950–1999, that

lulled recent investors into a false sense of security regarding long-term equity performance.”

The truth is, investors aren’t guaranteed to be rewarded for their added risk over the course of their short investment lifespan. Arnott notes that the odds of outperformance are still high, however, they’re no guarantee:

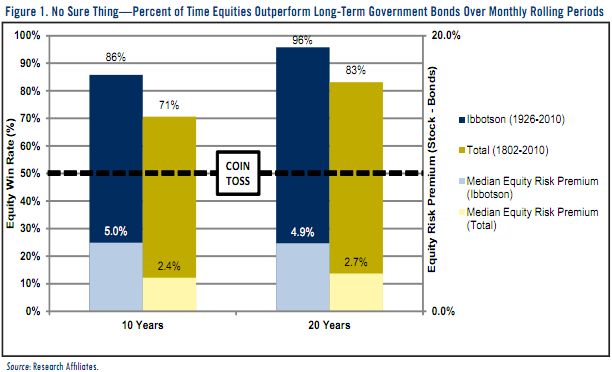

“Fortunately for the capital markets and equity investors, an examination of history shows that, yes, stocks have a high tendency to outperform government bonds over 10-year and 20-year periods. Figure 1 illustrates rolling 10- and 20-year “win rates” for equities versus government bonds. We break the data into Ibbotson (1926–2010) and Total (1802–2010). The Ibbotson timeframe confirms investor behavior in the 30 years since Ibbotson and Sinquefield published their groundbreaking study.7 For the vast majority of periods—86% for 10 years and 96% for 20 years—equities outperform bonds. But the longer

term data are less convincing. For 10-year periods, equities outperform in 71% of the observations, rising to 83% for 20 years.

A 70% or 80% win rate still offers pretty good odds. In professional basketball, those are average to above-average free throw percentages. But the relatively small probability of failure masks the magnitude of a miss. Just as a single missed free throw can cost a basketball championship, so too can an equity “miss” lead to drastic consequences, as the past 10 years have shown. There is no guarantee of superior equity returns, which begs the question: Why does our industry act like there’s one? More important, why take all that risk for a skinny equity premium?”

The worst part is that this all assumes an investor has the capacity to just sit tight on a buy and hold portfolio without ever getting panicked during the crises or going “all in” during euphorias. On paper, the buy and hold approach is easy to achieve (and even easier to sell!), however, the reality of the investment world is that there is no free lunch and contrary to what Wall Street might be selling you – a buy and hold equity approach is not a free lunch (unless you can afford and live for Warren Buffett’s favorite investing time horizon – forever).

So what’s the moral of the story? Don’t put all your eggs into the “stocks for the long-run” basket. The odds of you coming out on top are worse than you might think. Instead, consider a portfolio that involves multi-strategy approaches and broad asset allocation across low or negatively correlating asset classes. You aren’t guaranteed to outperform over the long-run, but you’ll sleep better AND eat better (primarily because you won’t feel the need to regurgitate your meal during periods such as 2008)….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.